December 19, 2018

By Carlos Hurtado, CPA | Nonprofit Audit Supervisor

In recent years, nonprofit organizations have drastically changed how they structure their relationship with related organizations. The relationship of an organization and its related entities is not only important to their operational, programmatic and financial goals; it may also significantly affect the audit of their financial statements. Organizations should also consider their entity type as well as the organizations’ individual goals before deciding whether to consolidate or combine. Understanding the conditions for each under the Financial Accounting Standards Board (FASB) is a great first step.

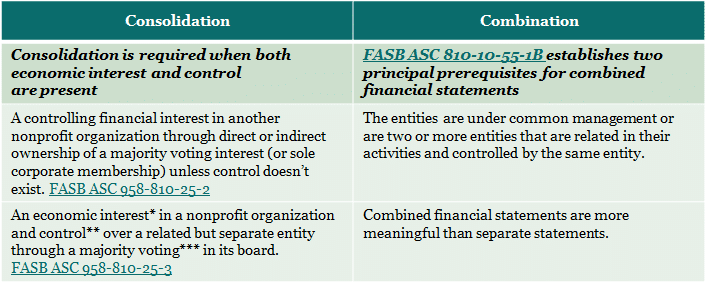

The conditions to combine financial statements are similar to the requirements for consolidation. When the relationship among two or more organizations implies controlling financial interest and control or economic interest and control, then consolidation is required. In contrast, when two or more related organizations are led by a common management and controlled by the same entity, combined financial statements are required.

The chart below explains when nonprofits should consolidate vs. combine financial activities with a related party.

* An economic interest exists when one nonprofit organization holds or provides significant services to another organization. An economic interest could also represent when the organization is responsible for the related organization’s main liabilities or holds significant resources that are committed to serve the main purposes of the related entity. If any of the aforementioned key factors are met for an economic interest, then the next step is to determine the control a nonprofit exercises over another.

** Control is embedded when a nonprofit organization has existing exclusive rights of having the ability to direct or manage the relevant activities through major contractual arrangements, significant investments, etc.

*** A majority voting implies when an organization share a significant amount of board members in common with another nonprofit entity or when a nonprofit organization is the sole member of the related entity.

Considering the type of relationship and then selecting the appropriate method for presenting financial statements may not be straightforward for every nonprofit organization. In the end, the financial statements should be presented in the format that is more meaningful and representative of the relationship among the organizations’ interests, activities and level of control. Following the guidelines outlined above is a great first step in mitigating the risk of inappropriate presentation. For questions about the requirements and presentation of consolidated vs. combined financial statements, contact Carlos Hurtado, CPA, Nonprofit Audit Supervisor at 301-951-9090 or churtado@grfcpa.com.