September 8, 2021

This post was originally published on the Sage Intacct Blog

Nonprofit audits are one of the best ways to demonstrate transparency and establish trust and credibility with funders and donors. But, if your organization is not prepared for the auditor, it can be a tedious and time-consuming process. With the right technology, you can benefit from an entirely paperless nonprofit audit. Your organization will enjoy greater efficiency and may potentially save money by being organized and well-prepared for your audit.

Recently, two nonprofit accounting technology experts presented a session at the virtual Nonprofit Finance Leaders Forum. They provided tips about:

- How to better engage your auditor

- How to create audit dashboards using Sage Intacct nonprofit accounting software

- Best practices to track and communicate the progress of your audit

Watch a replay of the Achieving a Paperless Nonprofit Audit session

A modern cloud accounting system, such as Sage Intacct, can help your organization set up roles and permissions and rights for users that serve as important internal controls your auditor will be examining. It also keeps an audit trail and log of changes to user rights and permissions. The dimensional database in Sage Intacct codes transactions with tags that allow you (and your auditor) to search and query your financial data more easily — a benefit in day-to-day operations and during an audit.

Get the auditor on board with your audit

Open yourself up to the possibility of giving your auditor access to your nonprofit financial system. There are several important benefits to providing your auditor read-only access to your accounting system, including:

- Ease of access: Allow your auditor to log on during the audit process and see what you see. A modern nonprofit financial system, like Sage Intacct, can limit an auditor’s access to read-only, so they cannot make any journal entries or change anything in the system. Sage Intacct also enables you to limit what areas of the system the auditor role can access. Now there should be less need for the auditor to call you and request production of paper reports and documents.

- Increased efficiency: The auditor is able to pull items as they need them without intervention from your accounting team. With Sage Intacct, the auditor can also ask questions or request additional information through the Collaborate and Checklist feature. This efficiency not only makes your audit less time-consuming; it can also decrease the overall cost of your audit.

- Use of dashboards: When you give your auditor access to your financial management system, you can create role-based auditor dashboards to help them find the information they need quickly and easily.

Create dashboards that facilitate your paperless audit

When you hear the term dashboard, your mind probably goes to reporting and data analysis. But there are other great use cases for dashboards outside of reporting. To help facilitate an audit, there are several types of dashboards that are useful:

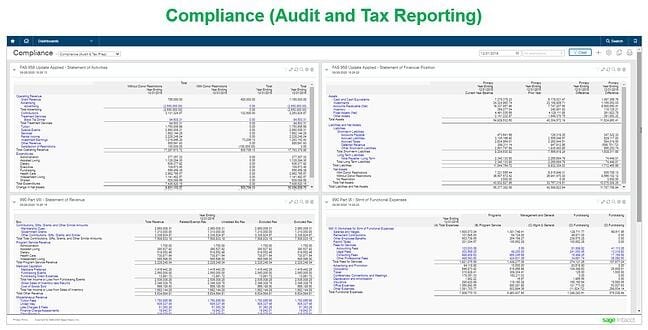

- A Compliance Dashboard with real-time audit and tax reporting displays information including your Statement of Activities, Statement of Operations and even workpapers that replicate portions of your Form 990 like your Statement of Revenue and Statement of Functional Expenses.

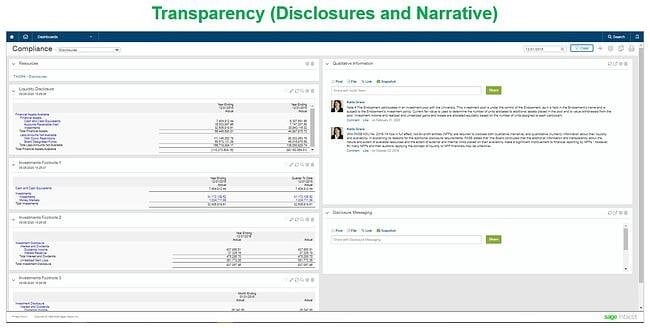

- A Quantitative and Qualitative Transparency Dashboard could include disclosures, footnotes, and other narratives and back-up support that demonstrate and explain their quantitative reporting. In the example below, you can see disclosures and footnotes as part of a larger compliance dashboard.

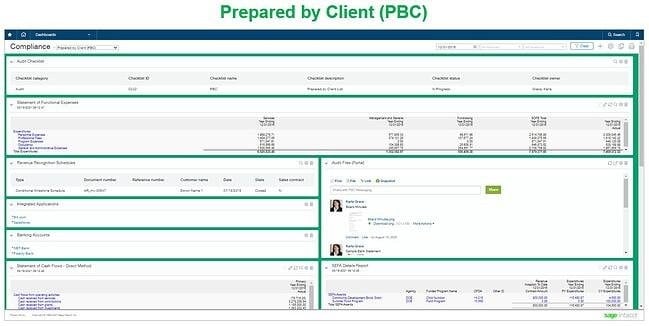

- A Prepared by Client (PBC) Checklist Dashboard pulls all the information together that auditors require while leaving that data safely secured within the financial system. This dashboard can be created with a checklist that allows you to assign items, track due dates, and track the progress of completion, as you can see below.

As you work through your PBC checklist, you can assemble and include collaborative attachments such as board minutes, bank statements, annual reports, and org charts. You can include trial balance, bank reconciliations, aging, and check registers. Auditors can review system records including approval queues and allocations. You can even make links to internal applications such as accounts payable, cash management, and fixed assets, or external links to websites, bank accounts, and more. It’s a one-stop for PBC that auditors will appreciate.

Conclusion

For a complete demonstration of how to achieve a paperless audit, be sure to watch the complete presentation. They show you exactly how to customize and utilize auditor-friendly features within Sage Intacct. They also provided lots more general tips and best practices for paperless nonprofit audits. Benefit from their audit and accounting wisdom when you watch the full presentation — and five other sessions by nonprofit finance and technology experts — at the virtual Nonprofit Finance Leaders Forum.