February 24, 2022

By Jennifer Galstad-Lee | Senior Manager, Tax

The U.S. tax filing season is officially underway! The IRS has started accepting and processing income tax returns for the 2021 tax-year as of Monday, January 24, 2022.

Filing Basics for Individuals

Remember that most income is taxable. Be sure to keep records for income items, including:

- Forms W-2 from employer(s);

- Forms 1099 from banks, issuing agencies, and other payers including unemployment compensation, dividends, and distributions from a pension, annuity or retirement plan;

- Form 1099-K, 1099-MISC, W-2, or other income statement for workers in the gig economy;

- Form 1099-INTfor interest received; and

- Other income documents and records of virtual currency

Don’t forget the following documents for the 2021 tax-year:

- Letter 6419, 2021 Total Advance Child Tax Credit Payments, to reconcile advance Child Tax Credit payments;

- Letter 6475, your 2021 Economic Impact Payment, to determine eligibility to claim the Recovery Rebate Credit; and

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance Premium Tax Credits for marketplace coverage.

Establish an Online Account on IRS.gov for Important Filing Information

The IRS offers an online account for each taxpayer with secure access to important tax information. Individuals who have not yet set up an online account with the IRS should create an account soon. (If you have already set up an online account, be sure you can still log in successfully.)

With your online account, you can securely gain entry to the Child Tax Credit Update Portal to review payment dates and amounts. You will need this information to reconcile your advance Child Tax Credit payments with the Child Tax Credit you can claim when you file your 2021 tax return.

You can also see your Economic Impact Payment amounts so you can accurately claim 2021 Recovery Rebate Credit if eligible.

Benefits to an online account with the IRS:

- View the amounts of your Economic Impact Payments;

- Access the Child Tax Credit Update Portal for information about your advance Child Tax Credit payments;

- View key data from your most recent tax return and access additional records and transcripts;

- View details of your payment plan (if applicable);

- View 5 years of payment history and any pending or scheduled payments; and

- Make a federal tax payment.

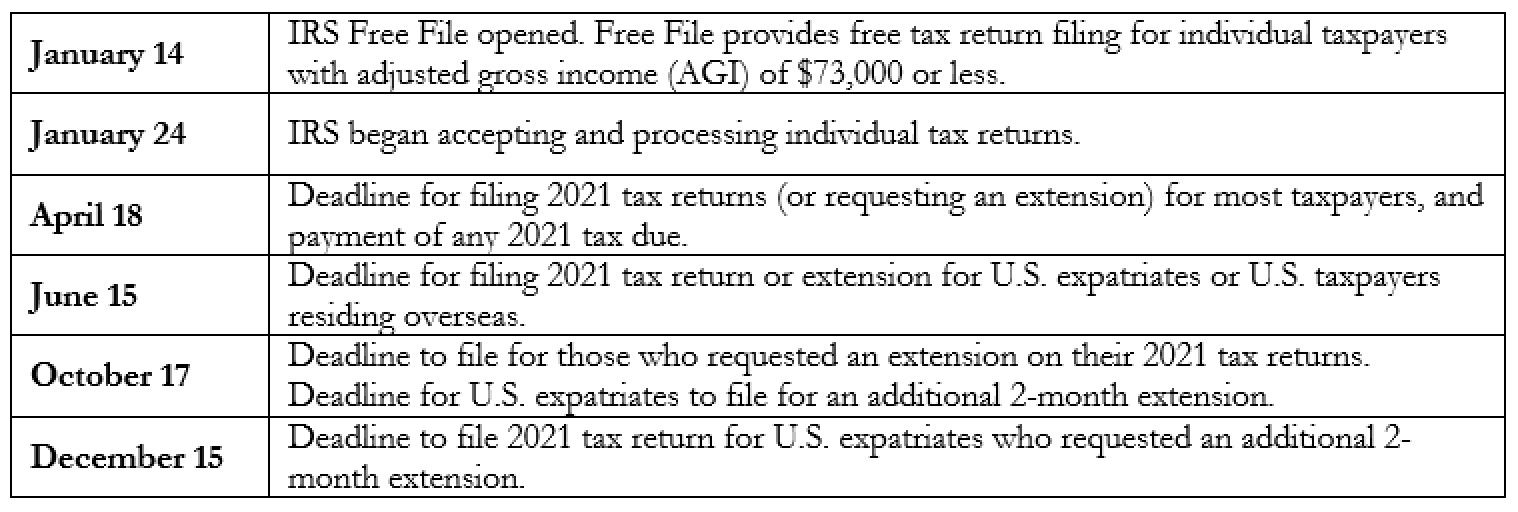

Key Filing Dates and Deadlines for Individual Taxpayers

Below are the key filing dates for individuals for the 2021 tax-year.

Processing of Prior Year Tax Returns and Tax Refunds

The IRS is attempting to reduce the inventory of prior-year income tax returns that have not been fully processed due to pandemic-related delays. Taxpayers do not need to wait for their 2020 return to be fully processed before filing their 2021 return.

The IRS encourages taxpayers seeking a refund to file their tax return as soon as possible. They anticipate that most tax refunds will be issued within 21 days of receipt if the return is filed electronically, there are no issues with the tax return, and any tax refund will be delivered through direct deposit. In addition to electronic filing, direct deposit is encouraged by the IRS to provide individuals with quicker access to their refunds. Those without a bank account can learn how to open an account at an FDIC-Insured bank or through the National Credit Union Locator Tool. Veterans can take advantage of the Veterans Benefits Banking Program (VBBP) for access to financial services at participating banks.

Contact

For more in-depth individual and business planning, contact us.