November 16, 2023

The year-end is a wonderful time to reflect what have been accomplished during the year, and how to strategize the remaining time to finish strong. For tax planning, the year-end provides an opportunity to review our financial standing for the year and consider key tax planning items for effective tax strategies. Here are 10 quick tips:

The year-end is a wonderful time to reflect what have been accomplished during the year, and how to strategize the remaining time to finish strong. For tax planning, the year-end provides an opportunity to review our financial standing for the year and consider key tax planning items for effective tax strategies. Here are 10 quick tips:

1. Review Your Numbers

Knowing your financial position is the starting point for tax planning. Evaluate your income. If your main taxable income is from employment or other fixed income, review your tax withholdings or estimated tax payments. Plan on how to pay any shortage in tax payments.

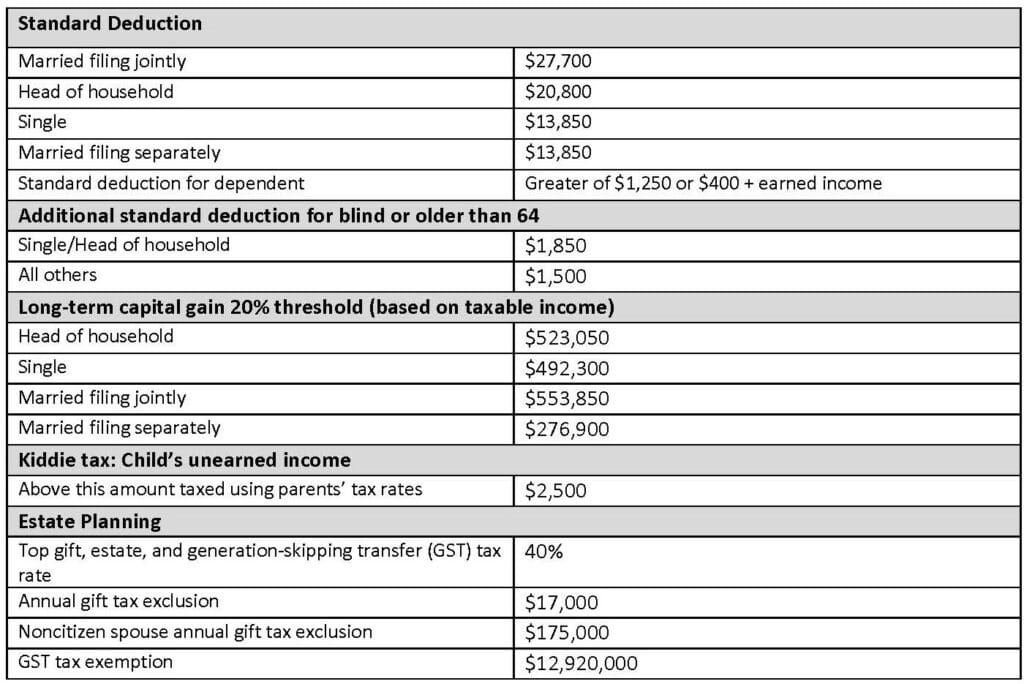

If your main income is from a business, project the annual net income. If the business is on a cash basis for tax porting, consider whether to decrease income by deferring receipts or increase deductions by paying vendors earlier before year-end. See Tax Figures for 2023 below for details.

2. Maximize Tax-Favored Retirement Plan Contributions

You have until Dec. 31 to put money in 401(k)s and other workplace retirement plans, and until April 15, 2024, to contribute to an IRA for 2023. You can stash up to $22,500 in a 401(k), $30,000 if you are 50 years old or older. The 2023 pay-in cap for IRAs is $6,500, plus $1,000 more if you’re 50 or older.

3. Donate to Charites

If you itemize deductions, donations to eligible charitable organizations are deductible. Consider making year-end donations of cash or property in good or better condition. Any charitable mileage is also deductible. It is important to receive proper documentation of your contribution to ensure you receive the full deduction. The maximum limit is 60% of Adjusted Gross Income (AGI) for cash contributions and 50% for non-cash contributions.

4. Consider the Electric Vehicle and EV Charger Tax Credit

If you are “going green” with your vehicle, you may be able to benefit from a tax credit of up to $7,500 for a new EV purchase, or up to $4,000 for a used vehicle. Check fueleconomy.gov/feg/tax2023 for the list of qualified vehicles (fueleconomy.gov/feg/taxused for used vehicles).

Keep in mind the EV tax credit provisions changed for 2023 and thereafter. Starting in 2023, there are also AGI limits to claim the credit. Modified adjusted gross income can’t exceed $300,000 for couples, $225,000 for household heads or $150,000 for singles. For used-EV buyers, the modified AGI thresholds are $150,000, $112,500, and $75,000, respectively.

If you install a home EV charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000.

5. Look Into Home Energy Tax Credits

Residential Clean Energy Credit is available if you install an alternative energy system in your residence home. Examples are solar panels, solar-powered water heaters, geothermal heat pumps, wind turbines, and fuel cells. Check here for eligible systems: energystar.gov/about/federal_tax_credits/non_business_energy_property_tax_credits The credit is equal to 30% of the cost of materials and installation.

Energy Efficient Home Improvement Credit is available for the costs of improvements such as exterior doors, windows, skylights, and insulation; HVAC; biomass stoves and boilers; and home energy audits. Check if improvements meet the requirements at Energy.gov: energy.gov/policy/articles/making-our-homes-more-efficient-clean-energy-tax-credits-consumers. The amount of the credit is 30% for 2023 through 2032, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual credit limit of $2,000), no lifetime limit.

6. Take Advantage of Long-term Capital Gains

The holding period of your investments has important tax implications. Long term capital gains (gains from assets held more than one year) are taxed at a preferential rates of 0%, 15%, and/or 20%, while short term capital gains are taxed as ordinary income. You may fully deduct capital gains against capital losses as well as offset as additional $3,000 against ordinary income ($1,500 for married filing separately).

7. Harvest Losses

Consider selling loser investment holdings to reap losses to offset capital gains. Remember the wash sale rule.

Note: Wash Sale Rule does not apply to Cryptos. If you buy substantially identical stock or securities within 30 days before or after sale date, the loss is disallowed. This is called the wash sale rule. Currently this does not apply to crypto sales, providing more opportunity for loss harvesting using your crypto holdings.

8. Time Your Deductions to Maximize Tax Benefits

The timing of deductions has an important impact on maximizing the benefit. An expense is only deductible in the year in which it is actually paid. If you anticipate your tax rate increasing in 2024, it may be a good idea to accelerate your spending for 2023 deductions.

9. Be Aware of New Laws

The recently passed Inflation Reduction Act (IRA) includes an extension to the excess business loss limitation rules, which disallow excess business losses for non-corporate taxpayers through 2028.The Inflation Reduction Act also extends the ACA premium tax credits through 2025. Households with income exceeding 400 percent of the federal poverty level will be eligible for the credit.

10. Stay Compliant

Late payments and filings as well as underestimated payments can result in large penalties and interest amounts. See Key Individual Filing Deadlines below.

Tax Figures for 2023

Key Dates of Note for 2023

November 13, 2023

Deadline for employees who earned more than $20 in tip income in October to report to their employers using IRS Form 4070.

December 11, 2023

Deadline for employees who earned more than $20 in tip income in November to report to their employers using IRS Form 4070.

December 31, 2023

Last day to sell stocks and other holdings to realize a gain or loss for the year

Last day for employees to contribute to qualified retirement plan

Last day to complete charitable contributions for 2023

Key Individual Filing Deadlines

January 16, 2024

2023 4th quarter estimated tax payment due

February 15, 2024

Income tax withholding claim (form W-4) due for the new year

April 15, 2024

Filing deadline for 2023 individual tax returns (or extension and estimated payment due)

June 17, 2024

2023 tax return filing due for US citizens or resident aliens living abroad

October 15, 2024

Due date for income tax return if extended timely by April 15

December 15, 2024

Due date for individual income tax return for U.S. expatriates if 2nd extension filed and accepted by the IRS timely by October 15, 2024

GRF Can Help

If you need assistance with your tax preparation, contact the GRF Tax Team, or reach out to me at the contact info below.