April 23, 2021

By Paul Calabrese, Principal, Outsourced Accounting & Advisory Services

For government contractors, Provisional Billing Rates (PBR) are a mandatory compliance requirement, but many encounter issues managing and projecting their indirect rates. Not only are indirect rates projections required by DCAA for government contractors who hold Cost-Plus-Fixed-Fee (CPFF) contracts, prime contractors and subcontractors who have mostly Time and Material (T&M) and/or fixed price contracts must project indirect rates to be profitable.

Small contractors without the expertise to project their indirect rates often default to market-driven billing rates (including indirect and profit) to avoid losses because they do not track historical indirect expenses. Unfortunately, many times these billing rates far exceed an accurate calculation of the contractor’s true expenses. To facilitate the projection of indirect rates, government contractors should develop an advanced indirect rate projection tool (such as an Excel pivot table) based on their next annual budget. Not only does this tool assist contractors with meeting the PBR requirement, they also have the confidence that their loaded billing rates under T&M and fixed price contracts will adequately cover their indirect expenses.

To begin the process of calculating and projecting indirect rates, it is critical to understand burden rates and the difference between fringe, overhead and G&A.

What are burden rates?

In a project or job cost environment, costs directly associated with government contracts are segmented by each separately funded contract or delivery order. These direct costs of labor, non-labor travel, miscellaneous direct costs like supplies, printing, postage, or major line items like material, purchased labor, purchased equipment, consulting and subcontracting, are only part of your total cost.

Indirect cost is the other piece of a project or job cost system that results in full cost recovery when combined with direct cost. Indirect costs are distributed to direct cost in an allocable, logical and equitable manner. The Federal Acquisition Regulation (FAR) Part 31.2 provides a formula for indirect cost computation and distribution via the use of a fraction with a numerator, known as a cost pool (because it is a group of indirect expenses). It is allocated in a causal beneficial manner to its denominator, called an allocation base, comprised of direct cost.

The mathematical ratio of the numerator to denominator is referred to as an indirect cost rate. Sometimes generically called “overhead,” meaning all the support costs that cannot be economically and feasibly identified directly and individually to a contract, and thus are “pooled” together and related in some fractional method. So direct costs are “burdened” or “loaded” with indirect expense, thus the references to burden rates or loading.

Types of indirect rates

Types of indirect rates

There are a number of names for burden or indirect rates in government contracting.

For service firms, the most common is a three-tiered indirect rate structure that includes fringe, overhead and General and Administrative (G&A).

Fringe benefits

Fringe benefits can be included in the overhead or G&A rates, but they can also be identified and tracked separately to measure the significant impact on direct and indirect labor. The fringe benefits numerator, or cost pool, includes:

- Paid absence (PTO, vacation, sick, holiday and other leave);

- Payroll taxes (social security and Medicare);

- State and federal unemployment tax;

- Workers compensation (paid through insurance companies);

- Long and short term disability;

- Pension (like 401k);

- Tuition assistance;

- Bonuses;

- Downtown parking;

- Use of metro transit;

- Health insurance (medical, dental, vision or some combination thereof);

- Life insurance (employee’s family is the beneficiary);

- Access to a gym; and

- Others, as appropriate.

These pooled benefit expenses are allocated over an allocation base (denominator) that includes both direct and indirect labor. The direct labor could pertain to several cost centers for various overhead pools. The indirect labor would include overhead labor (onsite or off government site), manufacturing, engineering, purchasing and receiving, subcontract handling, material handling, G&A or sales plus G&A (SG&A) indirect labor.

Under Cost Accounting Standard 420 incorporated in FAR Part 31, Bid and Proposal (B&P), as well as Independent Research and Development (IR&D) labor, is treated as direct project labor. It receives an allocation of fringe benefits (as well as applicable forms of overhead) and associated other direct cost and that are combined or “pooled” together and placed in G&A to be allocated over a total cost input base.

The fringe rate cost pool has a causal beneficial relationship to the productive (excluding paid absence) labor denominator comprised of direct and indirect labor cost. Mathematically the fringe cost pool and base have a statistical correlation. The numerator is a dependent variable and the denominator is the independent variable. As the allocation base increases or decreases, as impacted by sales or revenue, the cost pool will increase or decrease in the same manner based on the denominator. This is quite helpful for forecasting or projecting fringe benefits in future period based on regression or trend analysis.

Fringe benefits are assigned to a special “cost center” called a “service center.” A service center supports both the direct costs and indirect cost pools. Fringe benefits will be allocated or assigned to direct labor as a type of applied direct cost. Alternatively, it may be assigned to indirect labor and incorporated as applied fringe within a cost pool.

Overhead

To understand the difference between overhead and G&A expenses, it is helpful to recognize which costs are considered overhead for a government contractor. Overhead is the indirect support cost to manage a number of contracts possibly identified by “service line.” The service line in government contracting might be logistical support, engineering support, manufacturing support, or program management type of contracts.

Overhead costs are determined by “cost center.” A cost center is a place within a job cost ledger that collects a group of indirect costs (i.e. a cost pool) for further distribution to a final cost objective (i.e. a contract that contains directly identified cost and applied indirect cost), or a B&P or IR&D project as an intermediate cost objective to be included in a G&A cost pool assigned to a contract.

The overhead cost is required because multiple contracts necessitate a place for managing the operations of these agreements. A typical overhead might include a department head or VP with a support staff including technical advisors that will also assist in preparing proposals under B&P. If there were 10 contracts with each including 15 delivery orders, the VP would have to charge up to 150 direct projects on any given day. Since this is not economically feasible, contractors use an overhead rate (fraction of numerator and denominator) to allocate those indirect expenses associated with managing a given overhead.

Types of overheads might include “off government site” at the government contractor’s headquarters or at the government site, called “onsite” overhead. “Onsite” does not include facility-related expenses because the government site provides the facility and its related cost. The overhead might also be established by geographic location. Take for example, contracts managed in Norfolk, VA versus the Washington, DC metro area. In addition to each location being unique, the cost of operating is greater in the DC metro vs. tidewater Virginia.

Expenses in an overhead cost pool (numerator) would include:

- Indirect labor;

- Applied fringe or individual fringe expense accounts (if no separate fringe cost pool);

- Printing;

- Postage;

- Depreciation of assets assigned to this cost center;

- Amortization of leasehold improvements for office space assigned to this cost center;

- Occupancy cost such as office rent, utilities, repair and maintenance of owned assets for leased equipment;

- Non-capitalized equipment;

- Computers and computer related items such as software;

- State income taxes paid;

- Local business license tax;

- Corporate registrations for a particular state;

- Property tax for localities;

- Consultant support; and

- Other miscellaneous expenses.

The allocation base (denominator) would include direct labor dollars. If fringe benefits have their own cost center, then the allocation base could include direct labor and applied fringe plus B&P labor and applied fringe (if applicable). Alternatively, the base could be just direct costs and B&P labor. The resulting overhead rate would be applied to the direct labor within this cost center. One overhead or multiple overhead cost pools would be included in the G&A allocation base.

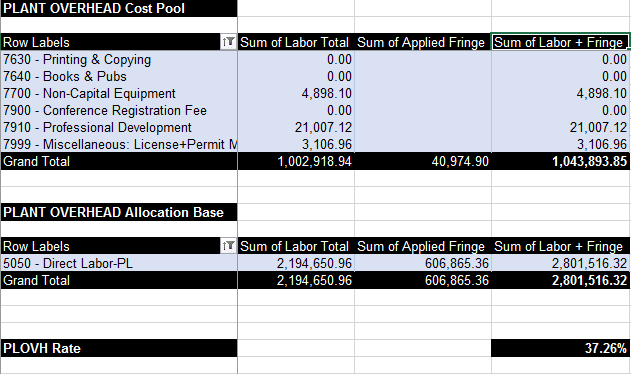

Example:

General and administrative (G&A)

Overhead is a smaller indirect cost pool to cover the effort of managing a group of contracts or product lines. Consequently, those indirect costs only apply and are allocated to impacted allocation bases, i.e. direct labor and B&P labor. In contrast, G&A indirect expense benefits the entire company as a whole and includes functional expenses like executive management, purchasing, IT, HR, marketing, B&P, IR&D, finance and accounting and contracts/subcontract administration.

Similar to the overhead cost pool, G&A has similar types of allowable indirect expenses like printing, postage, occupancy, etc. G&A has all of the indirect labor for the aforementioned functional areas plus the associated fringe, B&P, IR&D, audit, legal, other professional consultants, and website expenses.

There are also unallowable expenses that must be segregated (often within the G/L account series, such as 80000 assigned to G&A and 90000 assigned to unallowable indirect expenses). Unallowable expenses might include federal income taxes, interest, bad debts, advertising, public relations, exhibits at trade fairs, business or first class airfare, entertainment, organization costs, and others listed in FAR Part 31.2.

G&A is allocated over a Total Cost Input (TCI) base that includes all costs except G&A. The TCI would include direct labor and applied fringe for all cost centers, all types of overhead cost pools, all direct costs such as direct travel, direct supplies, direct material, direct equipment, direct consultants, and direct subcontractor expense, less the allocable fringe and overhead applied to B&P and IR&D that is placed in the G&A cost pool.

Key Takeaways

There are more combinations and complexities involved in burden rates for government contractors beyond the scope of this discussion. To summarize the key points of burden rates, it is helpful to remember the following when considering cost allocation for a government contract.

- The 3 common indirect rates for government contractors include fringe, overhead and G&A;

- The fringe rate is separated to monitor, manage and measure benefit expense;

- Overheads manage a group of contracts or a business line;

- G&A manages the entire organization; and

- Overhead differs from G&A in that it applies to operations whereas G&A applies to the entire company.

Next Steps

Based on the annual budget, advanced tools like an EXCEL pivot table assist government contractors with meeting their DCAA PBR requirement. An example appears below.

GRF CPAs & Advisors assists government contractors of all sizes with developing an annual budget that meets their individual needs. Our CPAs and advisors also help contractors calculate and project their indirect rates using tools like the Excel pivot table to ensure their compliance with DCAA and continued profitability. For more information on indirect rates or a consultation, contact Paul Calabrese at pcalabrese@grfcpa.com.

Types of indirect rates

Types of indirect rates