July 20, 2021

If you’re eligible for advance child tax credit (CTC) payments provided by the American Rescue Plan Act, you might wonder whether you should spend the extra cash. Some families are incurring extra child-care costs so the parents can return to work. But others don’t have any imminent child-care-related expenditures to cover.

Rather than spend the money on a trip to Disney or new smartphones, you might want to invest in your child’s future by starting or contributing to a tax-favored Section 529 college savings plan. Here’s what you should know.

CTC Basics

Through 2025, eligible parents could claim a child tax credit (CTC) of up to $2,000 for each qualifying child under age 17, of which $1,400 was refundable. (That means you could collect part of the refundable amount even if you had no federal income tax liability for the year.) However, the credit was subject to a phase-out, based on modified adjusted gross income (MAGI).

For 2021 only, the American Rescue Plan Act expands the child credit. The changes include the following for eligible parents:

- The maximum credit increases to $3,000 for a qualifying child. Plus, you can claim another $600 for each qualifying child under age six.

- The credit is 100% refundable. That means, if your CTC is larger than your tax liability, you’re still entitled to the full credit amount.

- The age threshold for a qualifying child increases from 17 to 18.

In addition, you don’t have to wait until you file your 2021 return to benefit from the enhanced child credit. The IRS will begin distributing advance payments to eligible parents on July 15 and continue them through December of this year.

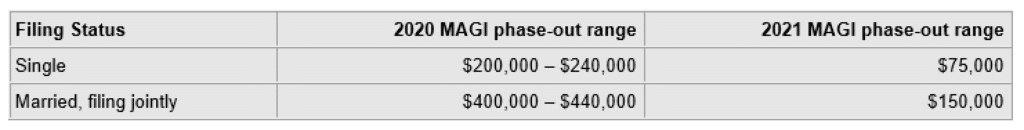

There’s one major downside to these changes: The modified adjusted gross income (MAGI) phase-out ranges for the child credit in 2021 are lower than they were before the new law.

Advance PaymentsHowever, some parents with incomes above the phase-out range for 2021 can elect to claim the child credit of up to $2,000 under the prior rules.

In June, the IRS sent out letters about advance CTC payments. You might already be on track to receive them because the IRS is using tax return data from previous years to determine eligibility. If you haven’t yet filed your taxes for 2020, the IRS will use your 2019 tax return. Checks or direct deposits for eligible parents will occur monthly, starting on July 15.

How much will you receive? If your income doesn’t exceed the levels listed above, your monthly payment will be:

- $300 a month for each child under age 6, or

- $250 a month for each child age 6 through 17.

For example, an eligible family with a four-year-old and a six-year-old would receive $3,300 between now and year-end [($300 × 6) + ($250 × 6)].

The IRS has introduced new online tools at irs.gov that might be useful to some people eligible for those credits. One tool enables families to opt out or unenroll from receiving these advance payments and instead receive the full amount of the tax credit when they file their 2021 return next year. Access it here.

Some taxpayers may want to opt out if they’re concerned that the advance payments will wind up being more than what they’re entitled to for various reasons. If a taxpayer receives excess payments over what they actually qualify for in 2021, they’ll be required to repay the excess.

Investment Opportunity

If you’re eligible for advance CTC payments — but you don’t need the cash today — you might want to consider socking away the payments for a major child-related expenditure that may be coming down the road: college.

For the 2020-2021 school year, the College Board estimates that the average annual cost of tuition and fees was $10,560 for in-state students at public four-year universities — and $37,650 for students at private not-for-profit four-year institutions. These estimates don’t include room and board, books, supplies, transportation and other expenses a student may incur.

Section 529 plans are special tax-favored educational savings accounts. They can be used to pay for college, as well as private K-12 school tuition. You can put in up to $15,000 per child into a Sec. 529 plan account in 2021 (or $30,000 if you and a spouse give separately). You can contribute more, but higher amounts would apply against your lifetime gift and estate tax exemption.

Some states allow tax deductions for contributions to Sec. 529 plans, but you can’t take a federal deduction. The major tax advantage comes on the back end: Contributed funds, plus any income and gains earned on those funds, can be withdrawn tax free if the withdrawals are used to cover eligible education-related expenses. This includes tuition, room and board, books and even computers.

Many states have 529 plans that incentivize the plans’ beneficiaries to attend in-state schools. However, your options aren’t limited to those state-sponsored plans.

Right for You?

There are many ways to spend — or invest — the cash you may receive from advance CTC payments. Some options are more fiscally responsible than others. Contact your tax advisor if you have questions about the CTC, opting out of receiving advance payments or setting up a Sec. 529 college savings plan.

© 2021