October 13, 2021

By Patrick Crosby, Tax Supervisor

The Research & Development Tax Credit (R&D credit) may hold the record for the most underutilized tax incentive available in today’s business environment. Too often, the R&D credit is overlooked simply because taxpayers are not aware of it or they do not believe that it applies to their businesses because they do not conduct research. In truth, provisions of the R&D credit have expanded since its inception 40 years ago and the credit is now available to more companies than ever.

For qualifying businesses, the R&D credit can provide significant tax savings freeing up cash to expand operations, hire new employees, further R&D efforts, and more. Given its tremendous potential, the R&D credit certainly deserves closer examination. In this article, we’ll touch on the history of the credit, examine the mechanics and methods for claiming it, and consider the future of the R&D credit in light of impending legislative developments.

A Brief History of the R&D Credit

The R&D Credit, known interchangeably as the Research & Experimentation Tax Credit, was enacted in 1981 to encourage innovation, boost investment in development, and ultimately increase technical jobs in the US. The credit originally expired at the close of 1985 but was later updated as part of the Tax Reform Act of 1986. The R&D credit was further classified as a Section 38 general business credit, subjecting it to an annual cap, while reducing the credit’s rate to 20% (the current basic credit rate).

The credit has evolved since the 1980s, with the most significant changes occurring in the last 20 years. In 2003, the “Discovery Rule” was eliminated, providing a taxpayer-friendly update that redefined the meaning of research activities as having to be “new to the taxpayer”, rather than “new to the world”. More recently, the PATH act of 2015 both solidified the R&D credit as a permanent statutory measure and modified the credit in favor of smaller-sized companies and start-ups.

Presently, the federal R&D tax credit, as prescribed by Section 41, is available to businesses that perform any activities related to the development, design, or improvement of products, processes, formulas, or software. Some of the typical industries that qualify for the credit include automobile, architecture & engineering, food & beverage, manufacturing, software & technology, telecommunications, transportation, and many others.

Mechanics of the R&D Credit

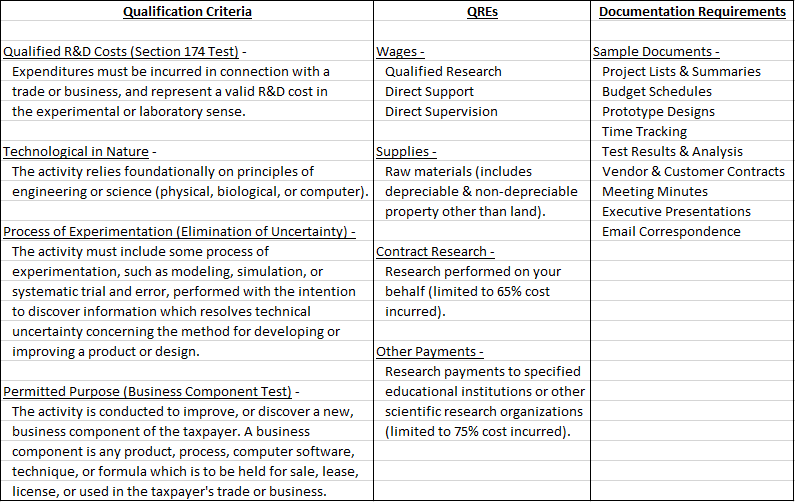

At its core, the R&D credit is accessible to companies that incur Qualified Research Expenditures (QREs) as part of specific, qualifying projects with the purpose of developing or improving products or processes. The below chart outlines the four-pronged test used to determine project eligibility, the QREs that qualify for the credit, and the documentation requirements necessary to support such activities and expenditures.

If research activities meet the four-pronged test, and the business complies with all documentation requirements, they can claim the basic R&D credit for their QREs on Form 6765 via two methods:

- Traditional (or “Regular”) Method – Under the traditional method, the credit equals 20% of a company’s current year QREs, over a base amount. The base amount calculation is complex, but essentially the base amount is the product of a company’s average annual gross receipts for the preceding four years and a fixed-based percentage (not to exceed 16%).

- Alternative Simplified Credit (ASC) Method – The ASC method may be easier for companies that either have not previously claimed the R&D credit or cannot provide the necessary data to compute their historical QREs. Under this method, the credit equals 14% of a company’s QREs for the current year above half of its average QREs for the preceding three years. If a company had no QREs in any of the three preceding years, the credit under the ASC method simply equals 6% of the current year QREs.

The main difference between these two methods is that the traditional method employs a fixed base while the ASC method uses a moving average base. The ASC method requires less documentation and computation but produces a reduced credit percentage.

Other Credit Considerations

Under Section 280C(c)(1), taxpayers are typically required to reduce their Section 174 research and development expenditures by the amount of the R&D credit claimed in a given year. This precludes a double benefit related to the credit, however Section 280C(c)(3) affords taxpayers the ability to elect a reduced credit instead of adding back the Section 174 expenditures (an often complex and time-consuming process). Starting in 2022, taxpayers will no longer be allowed an immediate deduction for their R&D expenditures and will be required to amortize the expenditures over time. More on this important update is discussed under Looking Forward: The Future of the R&D Credit.

The federal R&D credit is non-refundable, and any unused credit can be carried forward for up to 20 years or carried back 1 year. Businesses are also permitted to perform “look back” studies to ascertain whether they’ve left unclaimed R&D credits on the table for open tax years (generally 3-4 immediately preceding years) and amend past returns accordingly to claim the credit.

Newly established small businesses with significant research costs but little or no income tax liability are afforded an alternative to help immediately reduce their tax burden by applying the R&D credit against their payroll taxes (FICA) for up to 5 years. To qualify for this payroll tax offset, these companies must have no more than 5 years of gross receipts, and less than $5 million in gross receipts for the credit year.

Looking Forward: The Future of the R&D Credit

Historically, businesses have had the option of either expensing their Section 174 R&D expenditures in the year incurred or capitalizing and amortizing the cost of such expenditures over 5 years. However, a provision of the Tax Cuts and Jobs Act of 2017 eliminates this option and will require businesses beginning in 2022 to capitalize and amortize their R&D expenditures over 5 years for domestic research and over 15 years for foreign research. This impending change in the tax treatment of research expenses is a substantial deviation from the treatment in place over the past several decades. Further developments are possible over the coming months and should be monitored.

State Incentives for Research Activities

Many states have established their own R&D tax credit programs as well with varying rules and limitations. It should be noted that the federal R&D credit and most of the state R&D credit(s) are not mutually exclusive which allows taxpayers to potentially claim a credit at both levels. The Maryland (MD) state R&D credit, for example, is refundable (in contrast to the federal credit), and MD resident shareholders of S Corporations reap the benefits of an R&D credit claimed at the corporation entity level on their individual returns.

It is important to explore all state tax incentives for your research activities. Review the Tax Foundation’s map of state tax incentives for an overview of states offering R&D incentives. Consult a qualified tax advisor or state tax department for more information.

Maryland, District of Columbia, and Virginia R&D tax credit Programs

https://commerce.maryland.gov/fund/programs-for-businesses/research-and-development-tax-credit

https://dslbd.dc.gov/service/technology-incentivesresources

https://www.tax.virginia.gov/research-and-development-expenses-tax-credit-guidelines

Online Resources and Next Steps

While the R&D credit may seem intimidating with its technical jargon and seemingly burdensome calculations, it can offer significant tax savings for qualifying businesses. For more information about the R&D credit and possible benefits for your business, contact your tax provider or submit a question to the GRF CPAs & Advisors tax team.

Contact

For more in-depth individual and business planning, contact us.