September 12, 2018

By: John Pace, CPA, CVA | Partner and Director of Outsourced Accounting and Advisory Services

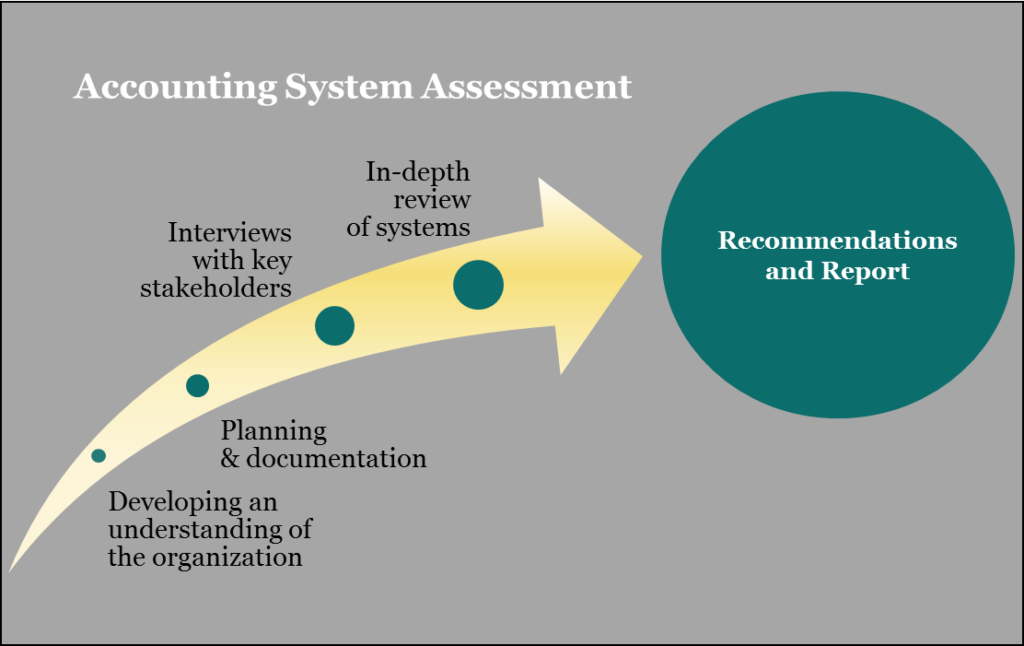

Despite adding accounting staff and implementing new software products, many organizations struggle with significant challenges related to their accounting function. Even with adequate resources and effective leadership, they may still experience issues with providing accurate reports, timely closing of the books, inefficient manual processes, absent internal controls, and/or accounting policy compliance, which can amount to a real problem for decision makers. The good news is that it may be easier than you might think to peel back the onion, identify these issues, and implement effective and meaningful solutions.

Your accounting system is more than the software supporting your accounting function. It also includes policies and procedures, workflow, and additional tools such as timekeeping, expense reporting and accounts payable applications. While working with clients on outsourced accounting and consulting projects, my team and I often encounter areas within their accounting systems that not only need improvement but also use staff resources better utilized on more strategic or value-adding projects. For example, many clients we speak with believe that they can never be free of paper and that transitioning their accounting to “the cloud” is impossible. Other clients feel stuck and believe that there are better, more modern solutions available to help streamline accounting processes, but they have no idea where to start. Furthermore, not receiving timely and accurate financial reports is a frequent complaint of management and other organizational stakeholders. Imagine what is possible if your accounting staff had more time to focus on what is most important to your organization.

The Benefits of an Accounting System Assessment

To determine if an accounting system assessment is a good fit for your organization, take a brief survey. To learn more and discuss your organization’s challenges and goals, contact John Pace, CPA, CVA at jpace@grfcpa.com or 301-951-9090.

John Pace, CPA, CVA is a partner at GRF and directs the firm’s Outsourced Accounting and Advisory Group. He oversees the full range of outsourced accounting services, supervises review and compilation engagements, and provides consulting for the firm’s nonprofit and for-profit government contractor clients. Mr. Pace is certified in Sage Intacct and holds the designation of Certified Valuation Analyst (CVA).

About GRF’s Outsourced Accounting and Advisory Group

This post is the first in a series of blog posts written by members of GRF’s Outsourced Accounting and Advisory Group. Beyond bookkeeping, GRF’s Outsourced Accounting and Advisory Group provides accounting support and strategic advice that gives clients the additional bandwidth to concentrate on their core activities. Our experienced staff supervised by certified public accountants provide on-site or off-site support and lend strategic advice to support clients’ decision-making process. Click here to learn more about the services we offer and find out how we are different.