August 15, 2018

By: Max Manley, CPA | Nonprofit Audit Manager

International NGOs (INGOs) working overseas in the development and humanitarian response sectors face a unique set of challenges and risks from both an accounting and operational standpoint. Whether your role resides at headquarters (HQ) or in a field office, as an INGO leader your responsibilities include managing a variety of known and unknown risks. Many leaders turn to an external field office audit to help them identify and understand these risks in order to make informed decisions for their organization.

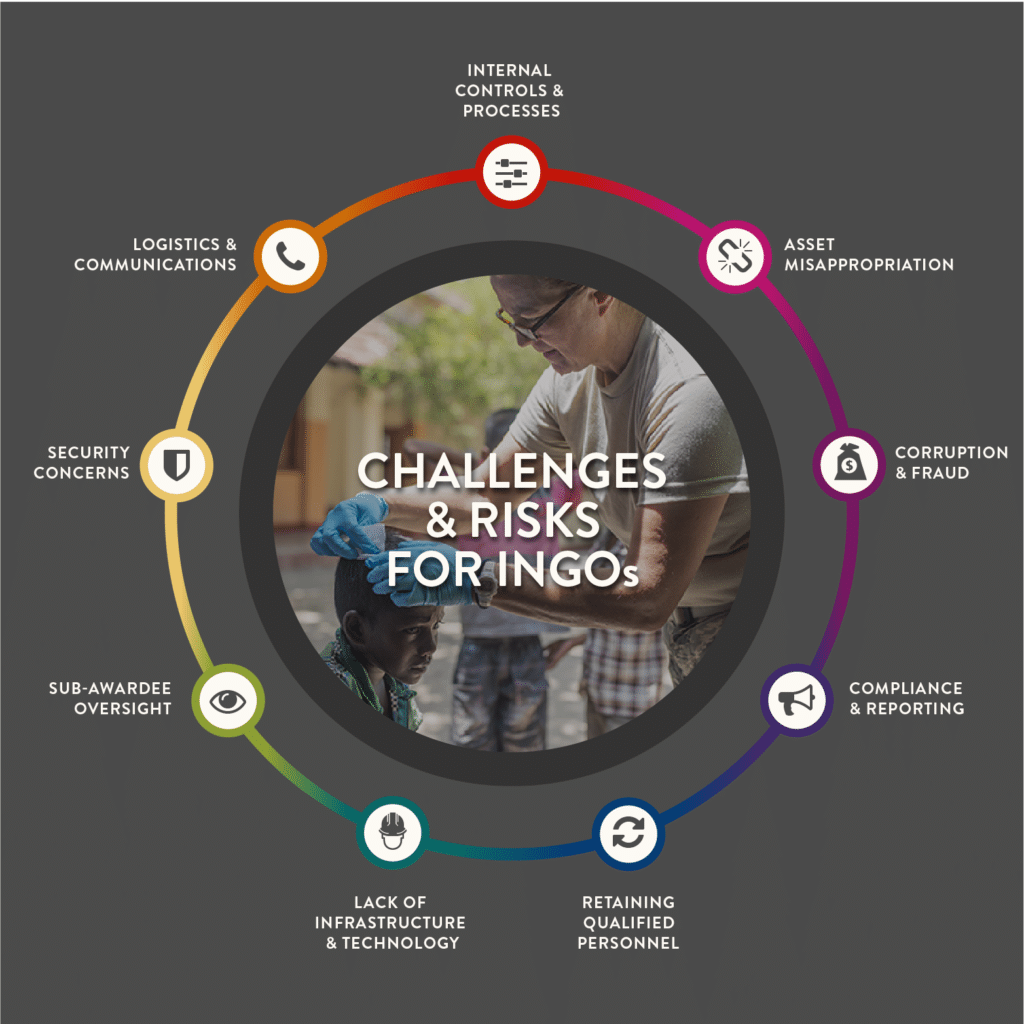

Challenges and Risks for INGOs

- While the overall strategies and management level decision making usually occurs at the HQ level, INGO field offices often operate as independent units of the organization with their own separate internal control structures, processes and hierarchy.

- The operating environment in the countries where aid programs are implemented may be plagued with security concerns, lack of infrastructure and technology resources, and cultures of corruption.

- In areas of extreme poverty and conflict, the potential for fraud and unethical business practices is significantly more prevalent.

- Basic living conditions, separation from friends and family, and demanding workloads often make it difficult to retain qualified personnel in the field.

- International aid funding comes with strict and complex compliance and reporting requirements

- While sub-awarding funding to local aid organizations that have depth of experience and knowledge in the community can be an effective means of program implementation, extensive oversight is critical to ensure proper financial management.

- Field offices may place increased reliance on cash transactions due to lack of access to banking facilities, creating risk of asset misappropriation and inadequacy in supporting documentation.

- Delays in the financial reporting process often occur due to the logistical and communication challenges inherent in the operating environment.

- In today’s digital world, people across the globe can communicate and share documents in real time, increasing the feasibility of remote management. However, time zone differences and slow internet connections can still hamper this process.

Given all of these factors, INGOs working abroad in developing countries must decide on appropriate risk mitigation and monitoring strategies for their overseas field office locations. In designing these procedures, the annual external audit process should be viewed as a resource and an opportunity to enhance the controls and effectiveness of field office management.

External Field Office Audits

While the benefits and efficiency of remote audit processes cannot be understated, an in-person visit to the field office by the external auditor provides additional opportunity for deeper insights and the potential to identify issues and areas for improvement that may not be evident from the home country. In addition, field offices are routinely visited by donors to conduct their own reviews, and a visit by the external auditor can help ensure that you are ready for such reviews and provide an element of transparency and assurance to donors that appropriate monitoring is taking place.

A typical field office visit by the external auditor would include:

- Comprehensive review of field level internal control procedures and identification of potential weaknesses;

- Meetings with field finance and program management to discuss the compliance requirements and the unique provisions of the awards being implemented through the field office;

- Open and honest discussions with all levels of field personnel to gain their first hand perspectives of the control environment and specific areas of challenges and concerns;

- Detailed testing of transaction samples to ensure adherence to appropriate compliance and documentation standards;

- Review of field level IT systems and related controls;

- Visits to project sites to inspect and verify the end results of program activities;

- Review and inspection of field equipment inventory to verify existence, condition, and accuracy of records;

- Provision of informal training and guidance to field staff;

- Follow up and investigation of specific areas of concern raised by HQ management; and

- A formal write up of findings and recommendations resulting from the visit for management’s consideration.

What is the Benefit?

Conducting an external field office audit provides INGOs with the opportunity for a deeper dive into their operations to identify possible issues, implement change and protect the reputation of their organization.

Examples:

A mid-sized INGO with new offices overseas was not familiar with how to comply with the applicable regulations or how to prepare and retain the required documentation. Over the course of a couple of years (including a field office audit), GRF guided them through the process of improving their systems and training their personnel. As a result, the organization has become much more efficient and completed the audit process with no significant findings this year. Our audit also uncovered that the organization was entitled to additional funds from a donor due to an oversight in the billing system.

A similar INGO client experienced fraud occurring with one of their local implementing sub-awardees. As part of an external field office audit, our CPAs reviewed their sub-recipient monitoring procedures and provided recommendations on how to enhance their policies to prevent any recurrences. Following the field office audit, GRF also provided recommendations to the client on ways to automate record-keeping processes for a cash distribution program and helped them identify and rectify issues associated with a new HR management system.

Would your organization benefit from an external field office audit?

- Consider your organization’s total spend by field office and the types of funding received. Do you have office locations where extra monitoring and audit attention is needed?

- When you consider the risks of the countries where your organization currently has field offices, have you experienced or received allegations of fraud?

- Are you planning to expand (open a field office) in a country where other organizations have experienced corruption, fraud and/or unethical business practices?

- Has a donor or government agency expressed special interest in the operations of a specific country in which your organization operates?

- Is a significant portion of your program awarded to a local aid organization?

- Does your organization lack an internal audit department or annual field office visits?

If you have answered yes to one or more of these questions, an external audit may be the best way to protect your organization from the risks inherent in field office operations.

Once you determine that an external field office audit is beneficial for your organization, talk to your external auditor about including it in the scope of work for your annual audit. For more information on how your organization can leverage an overseas field office audit to improve your operations and ensure successful execution of your mission, contact Jim Larson, CPA, Nonprofit Audit Partner at 301-951-9090 or jlarson@grfcpa.com.

About Gelman, Rosenberg & Freedman CPAs

Located in the Washington, DC metropolitan region with locations in New York and Baltimore, Gelman, Rosenberg & Freedman CPAs is a full-service professional services firm providing clients with financial, tax and consulting solutions. For more than 36 years, Gelman, Rosenberg & Freedman CPAs has served nonprofits and International NGOs, providing them with support for financial and regulatory compliance and allowing them to focus on the important programs they provide to local and global communities.

Our auditors and consultants are experienced in the latest regulations and compliance requirements. Our work in foreign offices puts us in a unique position to provide advice on issues such as field/brand office staff training in accordance with federal awarding agency requirements, local tax regulations, the procurement of goods and services, investment policies and grant management.