January 14, 2019

By Jorge Estrada, CPA | Nonprofit Audit and Tax Senior Manager

The Tax Cuts and Jobs Act (TCJA) passed at the end of 2017 made the most far–reaching changes to the tax code since 1986. While many in the nonprofit industry believe the changes in the tax law are creating a more challenging environment for fundraising from individuals, nonprofits who revise their fundraising strategy now will have a much greater chance of adapting to or even thriving under TCJA.

The Standard Deduction and Marginal Tax Rates

TCJA still allows a taxpayer to take a charitable deduction for a contribution to a qualified charity. If a taxpayer itemizes his deductions rather than taking the standard deduction, contributions become part of the itemized total. However, because the standard deduction increased (to $12,000 for individuals and $24,000 for married couples filing jointly) and the itemized deduction for state, local and real estate taxes is now limited to $10,000, many taxpayers who previously itemized will now find it more advantageous to take the standard deduction on their federal income tax return. In a January 2018 blog post, the Urban Institute and Brookings Institution Tax Policy Center estimated that over 21 million fewer households would itemize their deductions due to the increase in the standard deduction.

For example, in 2017 a married couple who had $9,000 of state income taxes withheld, $3,000 of real estate taxes, $7,000 of mortgage interest and $4,000 of charitable deductions (total itemized deductions totaling $23,000) would have itemized for 2017. In this case, the couple’s total itemized deductions of $23,000 exceeded the standard deduction for married couples of $12,700, so there was a tax benefit derived from the $4,000 of charitable contributions. Under the same scenario in 2018, itemized deductions would now total $21,000 because state income taxes and real estate taxes are limited to 10,000. Under TCJA, it would not be advantageous to itemize because the standard deduction of $24,000 in 2018 exceeds the total allowable itemized deductions. In 2018, there would not be a federal tax benefit to the taxpayers’ $4,000 of charitable contributions. In fact, the taxpayers in this example would have to make an additional $3,001 of charitable contributions to exceed the standard deduction and receive any benefit from itemizing their deductions.

In addition, the decrease in marginal tax rates also reduces the incentive for charitable giving. A paper released by the American Enterprise Institute, Charitable Giving and the Tax Cuts and Jobs Act, estimated that the increase in the standard deduction combined with the decrease in marginal tax rates would reduce overall charitable giving by $16 to $17 billion in 2018.

Fortunately, it is not all bad news for individual charitable giving. Qualified charitable deductions from IRAs are a provision that remains under TCJA and may now become an even more important vehicle for individual charitable contributions. Taxpayers over age 70 and a half years old with an IRA can elect to have distributions from their IRAs go directly to a charitable organization. These amounts do not count as a charitable contribution and the taxpayer is not subject to tax on the distribution, however the amount does count toward their minimum required distribution amount.

There are also some provisions of TCJA that actually increase the incentive for charitable giving by high net worth individuals. Prior to 2018, taxpayers could take a current deduction for contributions totaling up to 50% of their adjusted gross income. Under TCJA, the allowable percentage increases to 60% and amounts disallowed because of this ceiling would be carried forward to future years. Also prior to 2018, taxpayers with high incomes saw their itemized deductions phased out in prior years, potentially by as much as 80%. This phase out mechanism was repealed by TCJA so high-income taxpayers may see their charitable deductions count for more than previous years.

Revise Your Strategy to Encourage Individual Giving in Light of TCJA

Faced with the higher cost of charitable giving under TCJA, what can nonprofits do to preserve or even increase contributions from individuals? One of the most widely discussed charitable giving approaches for individuals is referred to as “bunching”. Under this concept, taxpayers make their planned charitable contributions for an extended period of time within a single year, which along with their other deductions allows them to surpass the standard deduction amount in that year. In subsequent years with no or fewer charitable deductions, these taxpayers take the standard deduction. This requires some careful planning on the taxpayer’s part, but making two or three years of charitable contributions in one year is an easy way to maximize the tax benefit. Similarly, a taxpayer can also set up a giving vehicle called a donor-advised fund (DAF) to stagger the distribution of their gift to the charity. A DAF allows a donor to make a charitable contribution and then recommend grants from that vehicle to a charity at specific times. The advantage to the taxpayer is that a contribution to a DAF provides an immediate tax deduction while allowing the taxpayer to control the timing of distributions from the fund to the charity. Understanding the charitable giving strategies employed by some donors as a result of TCJA, and adapting fundraising strategies to account for these changes in giving, can help a charity compete for fundraising dollars.

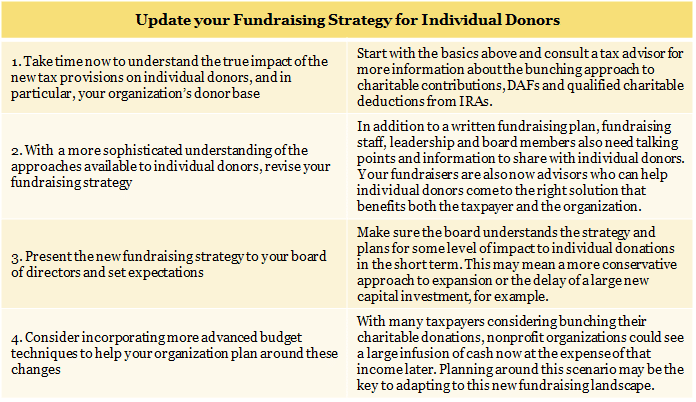

Bunched and staggered contributions also require nonprofits to consider more advanced budget planning techniques, educate fundraising staff and set realistic expectations with the board of directors and other stakeholders. Consider these steps to update your organization’s fundraising strategy for individual contributions.

A proactive strategy for dealing with the impact of TCJA on individual contributions is your organization’s best defense against a possible decline in fundraising. Begin with the steps outlined above and consult a CPA firm specializing in nonprofit accounting and tax to discuss your organization’s unique needs. For more information on the impact of TCJA, individual tax planning for donations, or developing a fundraising strategy for your nonprofit, contact Richard J. Locastro, CPA, JD at rlocastro@grfcpa.com or 301-951-9090. Nonprofits and individuals looking for more information on TCJA may also watch webinars available on the GRF website including 2018 Year-End Tax Planning and Update on Tax Reform and the Impact on Tax-Exempt Organizations.