January 7, 2019

By Lindsay Dean, CPA | Nonprofit Audit Senior Manager

In June 2018, FASB issued Accounting Standards Update (ASU) 2018-08, Not-for-Profit Entities (Topic 958): Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made. Nonprofit organizations with fiscal years that begin after December 15, 2018 and make or receive contributions should be prepared to implement the ASU immediately. Beginning with an understanding of the purpose of the ASU and the definitions outlined below is great first step in ensuring compliance.

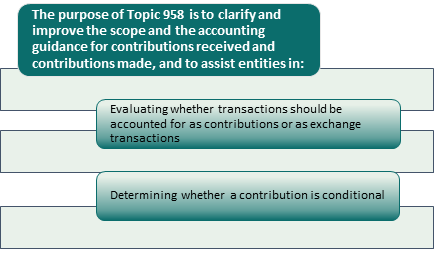

What is the Purpose of this ASU?

Practices have varied around characterizing certain transactions as exchange transactions or contributions, and on determining whether a contribution is conditional or unconditional. As a result, two entities may have applied generally accepted accounting principles differently to a similar transaction. In addition, the ASU on Revenue from Contracts with Customers (Topic 606) takes effect for nonpublic entities for fiscal years beginning after December 31, 2018, so identifying which transactions are exchange transactions is especially important at this time.

Contribution vs. Exchange Transaction

A contribution is an unconditional transfer of cash or other assets (or a reduction of its liabilities) in a voluntary nonreciprocal transfer. This varies from an exchange transaction, which is a reciprocal transfer in which each party receives approximately commensurate value. Items to consider when determining classification include:

- If the intent of recipient and resource provider is to exchange resources for goods and services of commensurate value, this indicates an exchange transaction.

- A benefit received by the public is not equivalent to commensurate value.

- Execution of the mission of the resource provider, or the positive sentiment is not equivalent to commensurate value.

If an exchange transaction is identified, Update No. 2014-09, Revenue from Contracts with Customers (Topic 606) should be followed.

Conditional vs. Unconditional Contribution

If a contribution is identified, the guidance clarifies what constitutes a conditional contribution. A donor condition must have both:

- One or more barriers that must be overcome before a recipient is entitled to the assets transferred or promised. For example:

- Performance barriers (i.e. a specified level of service or a specific outcome/outcomes)

- Matching

- An outside event

- Limited discretion by the recipient on the conduct of the activity (not to be confused with donor restriction that does not place limitations on how the activity is performed).

- Stipulations related to the purpose of the agreement (administrative and trivial stipulations such as routine reporting do not count as barriers)

- Note that a probability of meeting a stipulation is not a factor when determining whether an agreement contains a barrier.

- A right of return to the contributor for assets transferred or a right of release of the promisor from its obligation to transfer assets.

Conditional contributions are accounted for as either a liability (refundable advance), or are unrecognized until the barriers to entitlement are overcome.

Effective Date and Effect on Organizations

Nonpublic entities should apply the amendments for annual periods beginning after December 15, 2018 on a modified prospective basis.

The amendments should be applied to agreements that are either:

- Not completed as of the effective date

- Entered into after the effective date

Although each transaction should be reviewed individually by the entity, it is anticipated that this ASU will result in an increase in the number transactions being recorded as contributions. Of particular interest to entities that receive federal funding, the ASU gives one example of agreements that require assets to be used for allowable costs in compliance with the Office of Management and Budget (OMB), resulting in limited discretion by the recipient on the conduct of the activity. It notes that these agreements are often paid on a cost-reimbursement basis requiring the recipient to incur specific qualifying expenses to be entitled to the promised resources, indicating a donor imposed condition.

Now is the time to review all agreements to ensure that they are applying the proper guidance. Consider consulting a qualified CPA specializing in nonprofit audits to ensure agreement on any ambiguous transactions. For questions about compliance with this ASU, contact Nonprofit Audit Senior Manager Lindsay Dean, CPA at 301-951-9090 or ldean@grfcpa.com.