June 9, 2021

This post was originally published on the Sage Intacct Blog

Like more than 80% of small businesses, many nonprofits begin their financial lives using Intuit® QuickBooks® to manage accounting. It’s easy to use, well known, and offers entry-level accounting functionality at an affordable price. But as these organizations grow, they often face significant challenges and hidden costs as they hit the limits of QuickBooks’ functionality. For example, QuickBooks for Nonprofits was not designed for growing organizations that face complex demands like automating core processes, supporting distributed work teams, consolidating multiple entities, enforcing internal controls, or delivering insight with faster report times.

How do you know when your organization has outgrown QuickBooks for Nonprofits?

As your organization grows and becomes more complex, it’s quite common to become bogged down with manual data entry, unruly spreadsheets, time-consuming workarounds, and patched-together analyses. Here are some common telltale signs your nonprofit has outgrown the capabilities of QuickBooks:

- Insufficient information in reports to make decisions with confidence. Nonprofits often struggle to generate the reports they need to make better business decisions in real time.

- Manual processes and spreadsheets become unwieldy and prone to error. Organizations are forced to do cumbersome workarounds to manage multiple locations and perform operational analysis.

- Lengthy close of financial periods. QuickBooks does not offer dashboards or built-in capabilities for complex processes. Manual processes and spreadsheets are time-consuming to consolidate and offer limited visibility.

Say goodbye to manual entry and workarounds

Over time, many nonprofits gradually develop sophisticated accounting requirements such as revenue recognition and multi-entity consolidation. One major difference between Sage Intacct and QuickBooks for Nonprofits is automation. Sage Intacct nonprofit accounting software has built-in automation and workflows that streamline processes to save time and reduce errors while QuickBooks does not provide these built-in capabilities.

If you are using QuickBooks for Nonprofits as your financial foundation, it often means your team is forced to build cumbersome workarounds to complete these complex processes, leaving users over-reliant on spreadsheets and manual entry.

For example, at Atlas Network, the use of QuickBooks and Excel spreadsheets made it increasingly difficult to track and manage financials and funding grants to partners around the world. The nonprofit maintained a massive spreadsheet with roughly 20 tabs, each with up to 150 rows and 90 columns of data. The spreadsheet became unwieldy, prone to breakage, and wasn’t easily shared with other stakeholders. Once Atlas Networks made the switch to Sage Intacct, they boosted efficiency by 75%. They are also saving two weeks a month by automating journal entries that had previously been entered manually.

“Reporting efficiency has leapt 75% since we deployed Sage Intacct. I can answer questions from managers in minutes, rather than needing two days to dig up information from QuickBooks and Excel. I’m doing more reports and I’m doing them faster with Sage Intacct.”

Romulo Lopez, Direct of Finance, Atlas Network

Make faster financial decisions based on real-time data

As your nonprofit grows, you increasingly need the right information in real-time—and in the right format. Using QuickBooks, you’re stuck with canned reports and no dashboards, so your visibility is limited. Unfortunately, that means you’re often forced to make decisions based on outdated information.

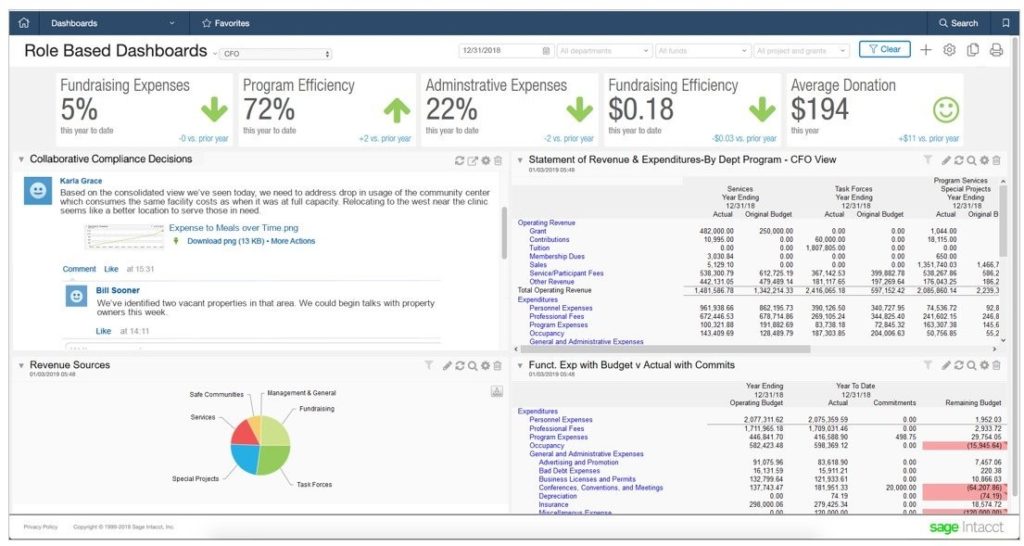

Sage Intacct provides real-time visibility into metrics and the flexibility needed to adjust budget and forecasting models in real-time. Dashboards give stakeholders access to meaningful, big picture financials at any time plus the ability to drill down into details and assumptions. Plus, you can easily customize reports to see the data you want all in one place.

Sage Intacct role-based dashboards give key stakeholders real-time visibility into KPIs enabling data-driven decision-making to drive mission success.

Drive growth with confidence and easily adapt to new requirements

As your nonprofit organization grows, you need an accounting system that can grow with you. QuickBooks was designed for the needs of small businesses and was not designed to manage the sophisticated processes of a growing nonprofit; and does not offer advanced functionality or robust financial controls.

On the other hand, Sage Intacct was designed for growth. It provides your nonprofit with a scalable architecture that allows for increases in transaction volume, the ability to add new entities and ledgers, and financial controls to ensure compliance and auditability.

When USA Fencing needed a more powerful system to handle nonprofit accounting needs and ease financial stewardship, they chose Sage Intacct to modernize financial processes and reporting. When using QuickBooks, USA Fencing had to spend a day every month manipulating data in Excel for restricted funding sources. With Sage Intacct, they are now able to provide personalized dashboards by project and get the granular visibility needed to satisfy stringent funding requirements.

“Now that Sage Intacct provides more meaningful, accurate visibility into our data, we’ve been able to easily meet stringent requirements from new funders and better manage our bottom line—ultimately bringing our asset balance into the black.”

Keri Khan, Director of Finance and Business Services, USA Fencing

Conclusion

Don’t lose valuable time managing unruly spreadsheets, struggling with manual processes, or allowing the limits of QuickBooks hamper your ability to grow. Your nonprofit’s sophisticated and evolving demands require flexibility, automation, and better visibility to strengthen financial stewardship and drive performance.

Assess your current capabilities and uncover the costs associated with your organization’s use of QuickBooks. Learn about the potential upside of switching to a modern cloud financial management and accounting system. Download the eBook, 5 Telltale Signs Your Nonprofit Has Outgrown QuickBooks (and what to do about it).