June 25, 2021

By: Paul H. Calabrese, Principal, Outsourced Accounting and Advisory Services/Government Contracting

As the COVID-19 pandemic comes to an end, many vendors, suppliers and service providers to the federal government have applied for forgiveness of their Paycheck Protection Program (PPP) loans. Working virtually meant that many professional service providers in particular did not need additional funding to keep their workforces intact, resulting in unused funding. With PPP loan forgiveness, government contractors with cost reimbursable contracts and grants are subject to the Federal Acquisition Regulation (FAR) 31.201-5 “Credits” and must pay an allocable portion of this money back to the government. Before considering any form of “payback” though, contractors should carefully review the updated Defense Contract Audit Agency (DCAA) guidance, identify any qualifying contracts and determine the appropriate application period.

Do the FAR Credits Apply to Your Contract?

FAR 30.201-5: “The applicable portion of any income, rebate, allowance or other credit relating to any allowable cost and received by or accruing to the contractor shall be credited to the Government either as a cost reduction or by cash refund.”

Credits or offsets must be applied to any cost reimbursable agreement if the government contractor has a cost reimbursable contract or grant. Typical cost reimbursable contracts include cost reimbursable with no fee, cost plus fixed fee, cost plus incentive fee, or cost plus award fee. The offsets could also affect the General and Administrative (G&A) indirect rate applied to your Other Direct Cost (ODCs).

Fortunately, certain types of US Government contracts do not require the contractor to apply a credit. Fixed price contracts are negotiated as a total price and do not consider or re-adjust elements of cost such as direct labor, fringe, overhead or G&A expenses. Since they are not subject to adjustment, the FAR Credits clause does not apply. This also is true for any private or commercial work, regardless of how the contract vehicle works, i.e. fixed price or Time and Material (T&M). If your government T&M contract does not have any ODCs like a Fixed Hourly Rate contract, they are not subject to later adjustment and no credits would be applied.

How to Apply the Credit

First, the FAR credits only apply if you hold a federally funded cost reimbursable contract and/or grants (including cooperative agreements), or if your cost-reimbursable state or municipal government contract follows the FAR. Contractors with a cost reimbursement contract likely did not need PPP funds since they are reimbursed for every dollar expended (up to a funded ceiling).

How you apply the credit or offset depends entirely on how you used the PPP funds. Those who are subject to the FAR credit should have carefully tracked the use of PPP funds to determine where a specific portion or all of the loan forgiveness should be applied. If your federal contact is cost reimbursable, there are a number of factors to consider before you credit the government for the forgiven loan amount. For example, you may need to consider whether you should credit an indirect cost pool or even which indirect cost pool. Each circumstance is unique.

With many federal agencies following DCAA guidelines, the agency released an updated Memorandum for Regional Directors (MRD) that provides additional guidance regarding PPP loans and subsequent credits to the government. Enclosure II includes the FAQ regarding crediting incurred costs (page 12).

When Should the Credit be Applied?

If a government contractor is required to apply an offset or credit, it is important to apply it to the appropriate period. The guidance provides that the offset or credit should be applied in the year the forgiveness was received, or in the year the loan proceeds were used.

Example

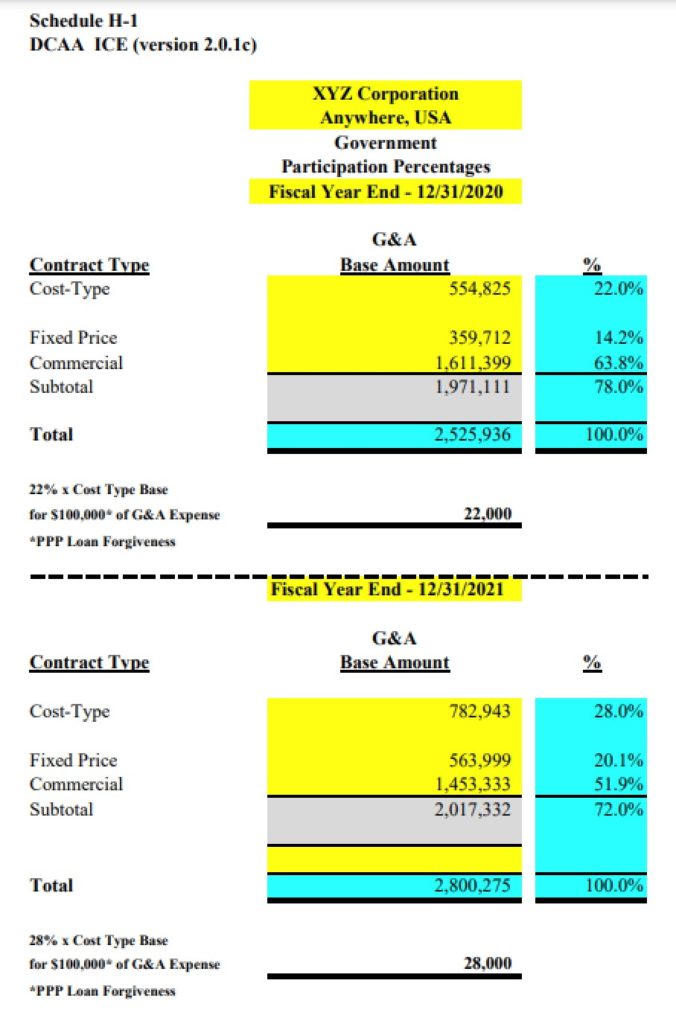

The comparative example here provides schedules for FY 2020 and FY 2021. The example illustrates the PPP loan’s impact of 22% to the G&A base for cost reimbursable contracts in FY 2020, which increases to 28% in FY 2021. Consequently, if the PPP loan forgiveness credit is $100,000, you will “pay more” in FY 2021 than FY 2020. By using the same logic, you would pay less if the situation were reversed.

Additional Questions and Next Steps

Does the PPP loan forgiveness credit apply if you have an American Association of State Highway and Transportation Officials (AASHTO) contract providing an annual general overhead rate for negotiation with a state government Department of Transportation? If you already provided your Incurred Cost Electronically (ICE) submission to your cognizant agency, can you retract and revise it? How and where should you disclose the PPP loan forgiveness credit? These are just some of the many questions you should consider before attempting to apply the credit. For more information about PPP loan forgiveness and FAR credits, as well as other government contract cost allocation questions, contact Paul H. Calabrese, Principal, Government Contracting at pcalabrese@grfcpa.com.