July 20, 2021

In March 2021, Congress enacted emergency legislation known as the American Rescue Plan Act (ARPA) to help individual taxpayers and small businesses weather the ongoing economic effects of the COVID-19 pandemic. Of the many noteworthy provisions included in the ARPA, perhaps no provision holds more significance to taxpayers with dependent children than the modifications made to the child tax credit (CTC). The new CTC provisions, applicable for 2021 only, deserve close examination as they can provide tremendous benefit to qualifying taxpayers.

For 2021, the child tax credit (CTC) increases to $3,000 for most dependents. Beginning in July, half of the total CTC will be paid in advance in six installments and enrollment is automatic unless the taxpayer opts out. Taxpayers with dependents should understand the impact of these payments on their particular tax position and opt-out if needed to avoid additional tax liability.

Summary of Child Tax Credit Rules

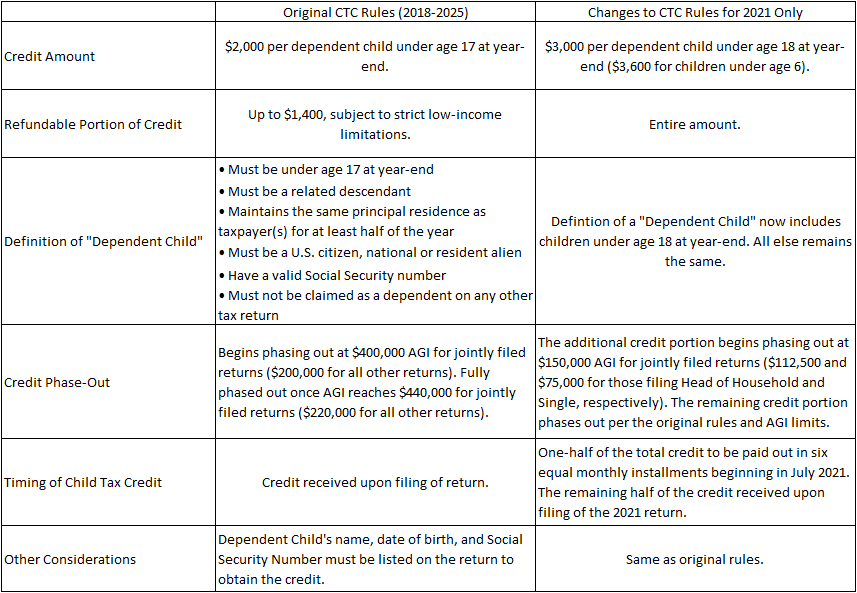

The ARPA both expanded the CTC and changed the timing in which taxpayers can receive it. The chart below summarizes both the original CTC rules and the changes to the CTC (applicable for 2021 only).

Advanced Payment of the CTC

The increase to, and the advanced payment of, the CTC for the 2021 tax year places more money in the pockets of taxpayers with dependent children, and sooner. All taxpayers who maintain a principal residence in the United States for at least half of the 2021 calendar year qualify to receive the advanced monthly payments, beginning in July 2021. The payments will be made primarily in the form of direct deposits, with paper checks or debit cards being issued to those families who do not have a bank account on file with the IRS. The dollar amount of the monthly advanced payments will be determined based upon 2020 return data (or 2019 return data, if a 2020 return has not been filed). The advanced credit will be reconciled with 2021 return data upon filing, and any additional credit owed will be refunded with the return. Conversely, if the total distributed advanced payments are determined to be more than the credit allowable on the 2021 return upon filing, the excess generally must be repaid to the IRS.

Should You Opt Out of the Advanced Payments?

Enrollment in the advanced payment program is automatic, but under certain circumstances, opting out of the program may be advantageous. Such circumstances could include an increase in taxable income, a decrease in allowable dependents, or a change in marital status. Any combination of these factors could disqualify a taxpayer from claiming the credit (either partially or in-full) based on 2021 return data, thus requiring reimbursement of the advanced credit payments to the IRS and possibly resulting in a higher tax bill come filing time in April 2022.

Online Resources

The IRS recently released two online tools – the Child Tax Credit Eligibility Assistant and the Child Tax Credit Update Portal. The CTC Eligibility Assistant can be used by taxpayers to determine if they qualify for the advanced credit payments. Another tool, the CTC Update Portal, can be used to view upcoming payments, provide/update bank information, and unenroll from the advanced payments if desired. Further features will be added to the portal throughout the year including the ability to update marital status and the number of expected dependents, and to note changes in income. Families who choose to opt out must do so using the online portal three days prior to the first Thursday of the following month (e.g. to unenroll in the advanced payment program beginning with the August 13th payment, taxpayers must opt out by August 2nd). For jointly filed returns, both the taxpayer and spouse must opt out.

Next Steps

In addition to the online tools noted above, the IRS has also published 2021 Child Tax Credit and Advance Child Tax Credit Payments FAQs to assist taxpayers with frequently asked questions about the CTC and opting out of the advanced payment program. For more information about the CTC and your specific tax situation, contact your tax provider or submit a question to the GRF CPAs & Advisors tax team.

Tax Supervisor

GRF CPAs & Advisors

301-951-9090

pcrosby@grfcpa.com