September 23, 2022

By Paul Calabrese, Principal, Outsourced Accounting and Advisory Services

Small Disadvantaged Businesses with 8(a) status must observe important yearly financial reporting requirements per 13 CFR 124.602. To correctly interpret the annual receipts definition and submit the appropriate annual financial statement, participants must understand the requirements in the CFR.

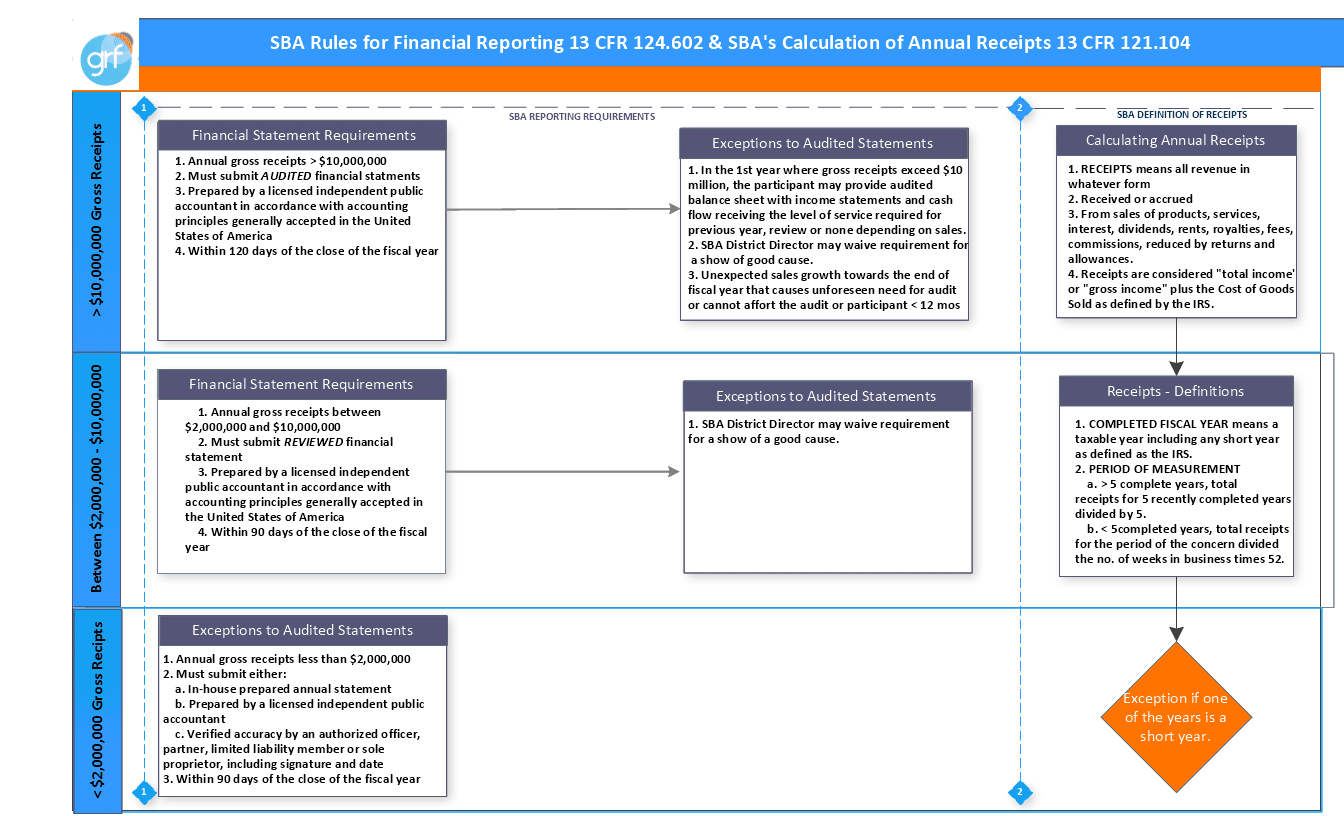

The chart below was developed by GRF’s team of government contracting specialists to help 8(a) program participants better understand their financial statement requirements, any exceptions to audited statements, and the proper calculation of annual receipts.

SBA Rules for Financial Reporting and Calculation of Annual Receipts

On the left side of the matrix in Box 1, three trimlines are represented for annual receipts under $2,000,000, receipts between $2,000,000 and $10,000,000, and receipts over $10,000,000. Any exceptions to the financial statement reporting requirements are indicated immediately to the right following the arrows. SBA’s definition of receipts appears on the far-right side of the matrix in Box 2 to help participants calculate annual receipts appropriately and notes an exception in the case of a short year.

Participants with less than $2,000,000 in revenue can either prepare in-house financial statements or engage a licensed independent public accountant to prepare a compilation. However, participants with revenue between $2,000,000 and $10,000,000 must provide SBA with reviewed financial statements prepared by a licensed independent public accountant. Finally, participants with revenue in excess of $10,000,000 must provide audited financial statements to SBA within 120 days of the close of the fiscal year.

Contact

GRF’s team of government contracting specialists provide audit, tax, outsourced accounting, risk advisory, and specialty consulting to 8(a) program participants and other entities who receive government funding in the form of federal contracts, grants, and cooperative agreements. Learn more about GRF’s services for government contractors at https://www.grfcpa.com/specialties/government-contractors/.

Principal, Outsourced Accounting & Advisory Services