February 8, 2022

By: Steven Lyons, CPA | Senior Manager, Outsourced Accounting and Advisory Services

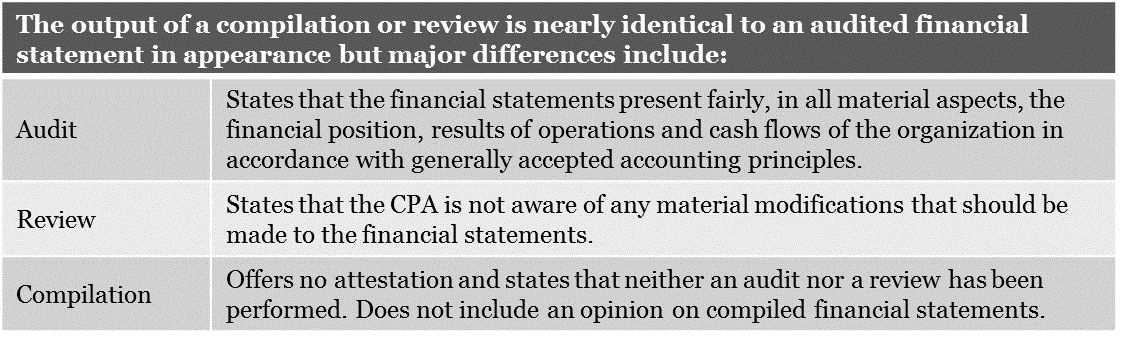

In addition to providing a more cost-effective alternative to a financial statement audit, compilations and reviews offer businesses and nonprofit organizations a number of important advantages. Perhaps most important, compilations and reviews help your organization prepare for a future financial audit because they include formal CPA-prepared financial statements as well as reporting requirements that align with financial requirements of shareholders. In other words, the financial statements are intended to be prepared by a CPA while also complying with the user’s financial reporting requirements. Unfortunately, many non-accountants use the term “audit” interchangeably with compilation and review, so determining which is most appropriate for your current needs is essential before engaging your CPA. Read on for more about the advantages of compilations and reviews and a comparison of the different levels of assurance in financial reporting.

Compilations

A compilation offers no statement on the fairness of the financials, but rather presents the client’s data in the form of financial statements. Although these financial statements will not be audited or reviewed, in most cases the financial statements will still be prepared in accordance with General Accepted Accounting Principles (GAAP). Your organization should be aware of GAAP reporting requirements, which involve both presentation and disclosure requirements. The presentation of the financial statements will include the balance sheet, income statement and the cash flow statement. It should be noted that these requirements under GAAP would be present in compilations, reviews, and audits.

A compiled financial statement usually includes appropriate disclosures that follow the accompanying financial statements. While disclosures vary by organization, all organizations are required to provide a description of the organization or company and their related purpose, the basis of presentation (this will inform the user of the basis of accounting used to prepare the financial statements), a description of their tax structure (C-Corporation, S-Corporation, Limited liability Company, 501(c) (3)), and revenue recognition polices. A compilation can be prepared without the required footnote disclosures. Due to cost restraints as well as no reporting requirements to outside parties, management may decide to remove the disclosures. The financial statements would still be GAAP compliant, but the CPA will include a separate paragraph to explain management has elected to omit substantially all the disclosures that would ordinarily be included in the financial statements

A compilation engagement can serve as a valuable resource for understanding the requirements of GAAP-prepared financial statements during an audit. The similarities in accounting and reporting requirements will put you one-step ahead for your first audit.

Reviews

Similarly, a financial statement review presents the client’s data in the form of financial statements but states that the CPA is not aware of any necessary adjustments. Like an audit, a review presents the financial statement according to GAAP and has the same financial statement requirements.

A review requires procedures that are also helpful in preparing your organization for its first audit. For example, the CPA will make inquiries concerning your financial data as well as your accounting procedures and processes for the year under review. Your accounting staff will provide explanations for increases or decreases in account balances from year-to-year, and there may be requests to provide source documents to validate account balances. The CPA may request bank reconciliations and bank statements, a listing of your customers’ and vendors’ open balances, as well as other schedules to determine the accuracy of the organization’s financial data.

If your CPA finds discrepancies between the supporting documents provided and the amounts listed in your accounting system, he or she may propose corrective actions for the financial data. This may include journal entries, memos documenting the discrepancies were immaterial and no further adjustments are required, and meetings with management to determine a resolution.

A number of analytical procedures may be performed during a review if your organization is discussing its financial data and processes with a CPA. During an audit, you will be required to go through a similar process, but with additional requests for supporting documents as well as details to support the explanations. While a review may not be as rigorous as an audit, the review requirements along with the financial statement disclosures will help the organization prepare for similar procedures during an audit.

Audit, Review and Compilation — A Comparison

An audit of financial statements is the highest level of assurance that a CPA provides. It offers a deep dive into the organization that includes evaluation of internal control, an assessment of fraud risk, and other procedures with the goal of obtaining reasonable assurance about whether the financial statements are free from material misstatement. Following the audit, the independent auditor issues an opinion stating that the financial statements are fairly stated and in accordance with generally accepted accounting principles.

Additionally, in comparing audits, reviews and compilation, the organization must evaluate independence as it relates to their CPA. In order for an audit or review to be prepared, the CPA must be independent of the organization. The CPA cannot make management decisions on behalf of the organization and still prepare an audit or review. A CPA is not required to be independent to prepare a compilation. In a compilation engagement, a CPA is allowed to assist the client with making management decisions (if necessary) and prepare external financial statements.

While not as rigorous, both a review and compilation can serve as a resource for preparing your organization for an audit. They both incorporate financial statements requirements and disclosures that your organization will need for a future audit. As an accounting professional, understanding the difference and practical application of the audit, review and compilation will help you select the best solution for your financial reporting needs.

Next Steps

For more information on reviews and compilations, contact Steve Lyons, CPA, Senior Manager at GRF CPAs & Advisors, at slyons@grfcpa.com or 301-951-9090.

Senior Manager, Outsourced Accounting & Advisory Services

Mr. Lyons has been with the firm since 2006 and has worked in the accounting and financial industry since 2001. His expertise ranges from audit assurance, accounting outsourcing, and financial statement preparation. His responsibilities include overseeing and completing reviewed and compiled financial statements according to Generally Accepted Accounting Principles (GAAP), and outsourced accounting engagements for both nonprofit organizations and for-profit businesses.