November 11, 2021

By Jennifer Galstad-Lee, CPA, JD, Tax Manager

November is a great time to review your taxable individual and business income with the goal of maximizing your tax strategies for the current year. Below we provide some helpful checklists and schedules to guide you through some key tax considerations.

Individuals

Summarized below are several tax moves individuals can use to reduce their tax liability for 2021. Read additional GRF articles in the 2021 Year-End Tax Planning Series on tax credits applicable to families and tax strategies for college savings.

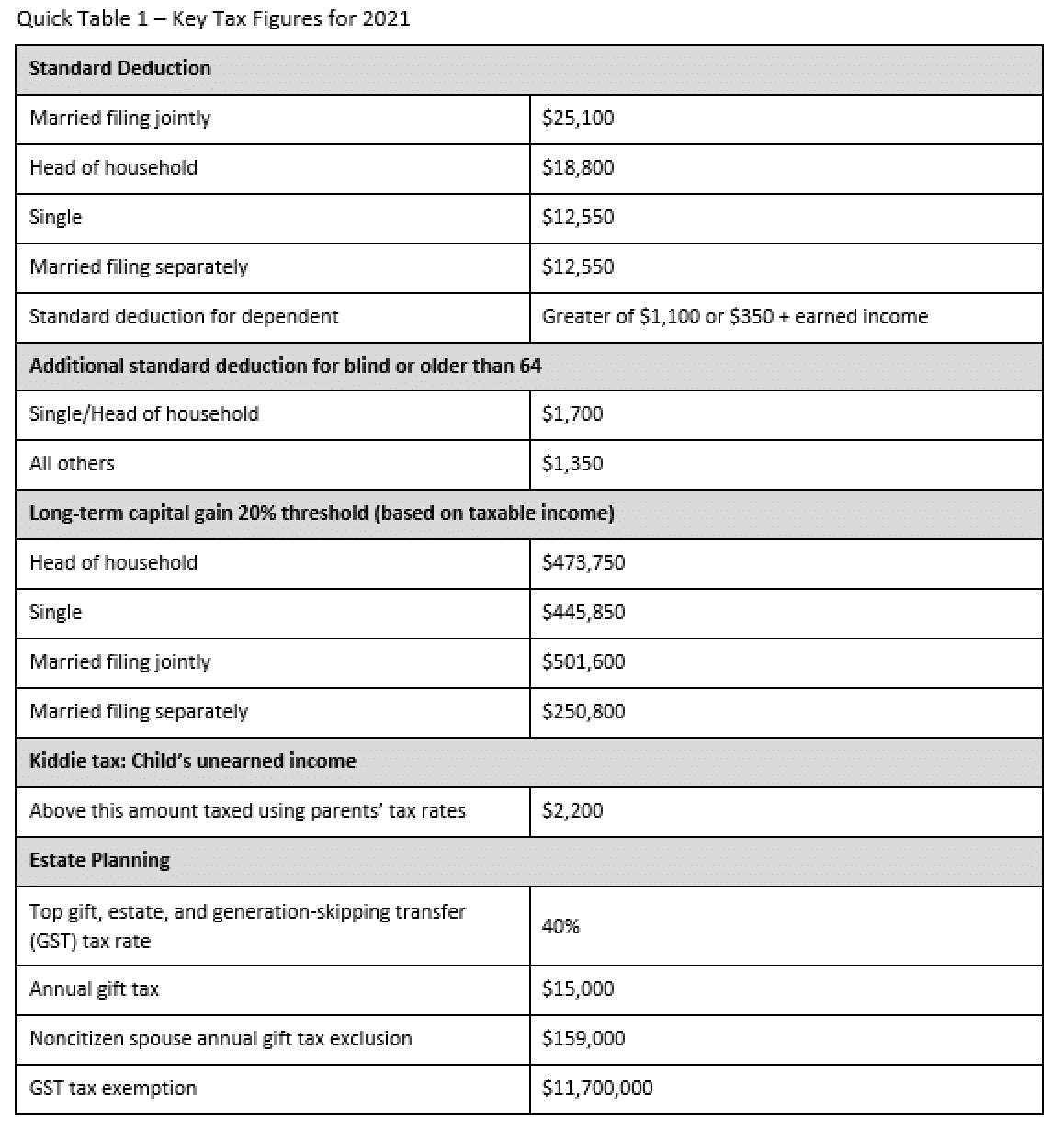

- Estimate your 2021 and 2022 taxable income. This is a critical step before you can make tax moves. More accurate estimates on taxable income will help you understand the marginal (and effective) tax rates you would be subject to this year. See Quick Table 1 for key tax figures for 2021.

- Fund tax-deferred retirement accounts. An easy way to reduce your taxable income is to fully fund retirement accounts that have tax-deferred status. The most common accounts are 401(k)s, 403(b)s and various IRAs (traditional, SEP and SIMPLE).

- Take your required minimum distributions (RMDs). The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 raised the age when you must begin taking RMDs from a traditional 401(k) or IRA from 70½ to 72. Individuals who turned 72 must begin RMDs for 2021. The first RMD may be deferred until April 1, 2022, which would mean taking two RMDs in the same year. Don’t forget to make all RMDs because the fines are hefty if you don’t — 50 percent of the amount you should have withdrawn.

- Manage your gains and losses. Rebalance your investment portfolio and take any final investment gains and losses. If your losses exceed your gains, up to $3,000 can be used to reduce your ordinary income. Now is a good time to talk to your financial advisor about gain or loss harvesting.

- Finalize your gift-giving strategy. For 2021, you can gift up to $15,000 per donee which can be for as many individuals as you choose) without gift tax or reporting requirements. This could include gifts of cash or property, and investments. You may want to consider gifting appreciated securities to someone with modest income who will pay no income tax on long-term capital gains. But remember that gifting to dependent children often does not give tax savings due to “kiddie tax” if their investment income exceeds a certain amount ($2,200 for 2021).

- Donate to charities. Consider making end-of-year donations to eligible charities. Donations of property in good or better condition and your charitable mileage are also deductible. Receiving proper documentation that acknowledges your contributions is important to ensure you obtain the full deduction. New for 2021, individuals who don’t itemize can deduct cash donations up to $300 made to qualifying charities ($600 for married joint filers). Also new for 2021, the adjusted gross income limit for cash contributions has been increased to 100%.

- Qualified Medical Expenses.Personal protective equipment (PPE) purchased to prevent the spread of COVID-19 qualifies as medical expenses. Items such as masks and hand sanitizer are also eligible to be paid, or reimbursed, under medical expense accounts such as FSAs, HRAs, HSAs, and MSAs. If such costs are not reimbursed, the costs can be included as a deductible medical expense. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) signed into law in March 2020 also made menstrual care products qualified medical expenses. Deductible medical expenses must exceed 7.5 percent of the taxpayer’s AGI, and the taxpayer must itemize to receive a benefit.

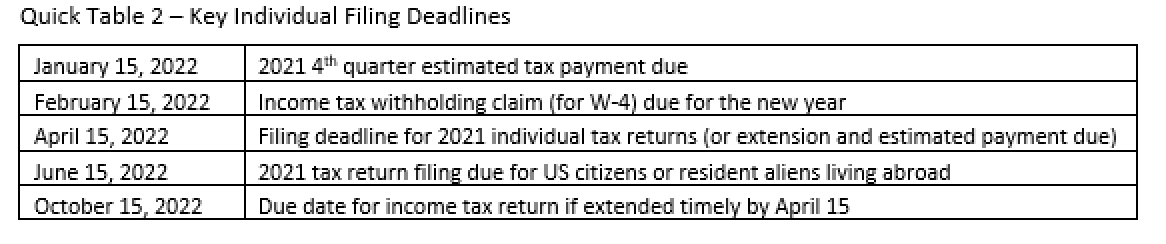

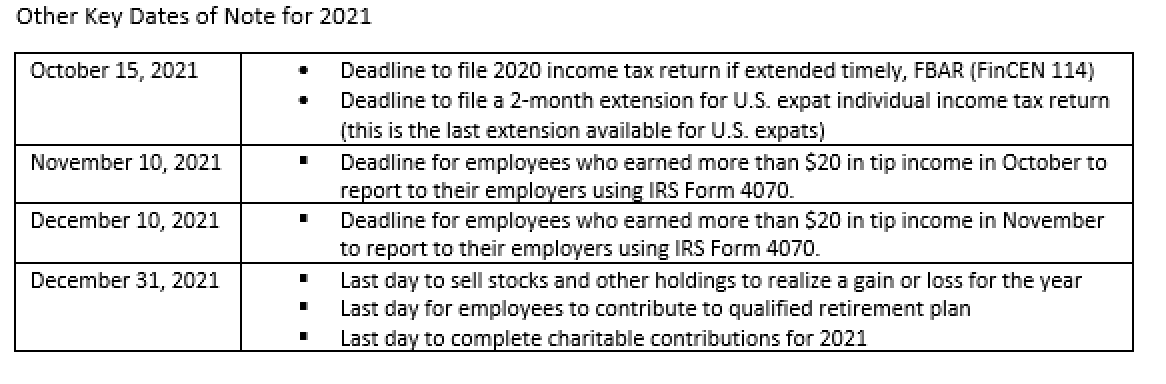

- Be tax compliant. Complete, accurate returns and timely filing and payments could save you the most. Late filings or delayed and underestimated payments can result in exorbitant penalties and interest. This is particularly important for U.S. citizens or resident aliens with foreign income or assets who often overlook required international filing requirements. See Quick Table 2 for key filing dates.

Businesses

Below are some 2021 tax savings strategies for business owners to consider. These strategies are not “one-size-fits-all”, so owners should consult their tax advisor with questions about eligibility and impact to their tax liability.

- Time income and deductions. Consider shifting business income to next year or future periods if you expect to be subject to lower tax rates in future years. Conversely, consider moving deductible expenses to next year if you expect to have higher income or be subject to higher tax rates. If you expect to realize large gains on sale, consider an installment sale to spread taxable gains over several years. However, for certain cases (especially pass-through entities), it might be better to capture gains early on depending on the owners’ tax postures.

- Take advantage of business tax credits. Evaluate business tax credits that might be available to your business. Featured below are some of the tax credits available for 2021.

- The Employee Retention Credit (ERC) is now available under the American Rescue Plan. Businesses can offset their current payroll tax liabilities by up to $7,000 per employee per quarter. The credit of up to $28,000 per employee for 2021 is available to small businesses who have seen their revenues decline, or even been temporarily shuttered, due to COVID. If your business is eligible for the ERC for 2020 and you have not yet claimed the credit, you can file amended payroll tax forms to claim the credit and receive your tax refund.

- The American Rescue Plan also extended the Paid Leave Credit for small and midsize businesses that offer paid leave to employees who may take leave due to illness, quarantine, or caregiving through September 2021. Businesses can take dollar-for-dollar tax credits equal to wages of up to $5,000 if they offer paid leave to employees who are sick or quarantining. If your business provided paid leave to employees in 2020 and you have not yet claimed the credit, you can file amended payroll tax forms to claim the credit and receive your tax refund.

- Small businesses that offer health care plans can benefit from the Credit for Small Employer Health Insurance Premiums. To qualify, the business should have fewer than 25 full-time employees, pay average wages less than $50,000 a year per full-time equivalent (indexed annually for inflation, $56,000 for 2020), and pay at least 50 percent of the cost of employee-only – not family or dependent – health care coverage for each employee. The maximum credit is 50 percent of premiums paid for small business employers and 35 percent of premiums paid for small tax-exempt employers. The credit is available to eligible employers for two consecutive taxable years. The credit is claimed on Form 8994.

- The Research and Development Tax Credit (R&D credit) incentivizes businesses to stimulate innovation, technical design, and manufacturing. The credit can be significant especially if the business is already incurring qualifying expenses. A fair amount of documentation is required to qualify, so ask a tax specialist about considerations and requirements. For more on this tax credit, read GRF’s blog post, The R&D Tax Credit: Are You Leaving Money on the Table?

- The Energy Investment Tax Credit (ITC) incentivizes businesses to engage in more energy-efficient or “green” processes. Eligible investments include solar, fiber optic solar, fuel cells, small wind, and waste energy recovery property. Solar energy has a permanent 10% ITC. Temporarily, the credit rate for solar was increased to 30% through 2019, before being reduced to 26% through 2022 and 22% in 2023. Some states offer energy tax credits as well.

- The Credit for Employer-provided Childcare Facilities and Services offers employers a tax credit of up to 25% of qualified childcare expenditures and 10% of qualified childcare resource and referral expenditures capped at $150,000. Qualified childcare expenditures are amounts paid or incurred to acquire, construct, rehabilitate, or expand property to be used as part of a qualified childcare facility of the business. For the complete list of requirements, please consult with your tax advisor. The credit is claimed on Form 8882.

- Consider buying equipment or vehicles for depreciation deductions. Each year businesses may elect to take write-offs (depreciation) on purchases of business equipment and vehicles. Depreciation deductions can be taken more quickly. In many cases, you can take the entire cost in the first year you own and use the equipment. The two most common types of accelerated depreciation available are Section 179 deductions and bonus depreciation.