Home / Leadership Team / Troy Turner, CPA

Biography

Mr. Turner has worked in the tax area of public accounting since 1997 and has a broad range of tax consulting experience. The former director of GRF’s Tax Services division, he specializes in providing tax advisory and compliance services for businesses and individuals who have international aspects to their tax situation. For individuals, he focuses on expatriate taxation, nonresident alien reporting, state domiciliary determinations, tax treaty exemptions, international investment reporting, tax equalization, FBAR compliance, foreign entity ownership reporting, and complex US-based tax filings for high-net-worth individuals. On the business side, he has extensive experience in the areas of corporate review, tax provision calculations, entity selection, accounting method changes, business sales, foreign ownership, and CFC reporting.

Mr. Turner is a regular speaker on international and domestic tax topics for GRF’s monthly webinar series as well as outside groups.

Education and Certifications

- B.S. in Accounting, Virginia Polytechnic Institute and State University

Professional Affiliations

- American Institute of Certified Public Accountants (AICPA)

- Maryland Association of CPAs (MACPA)

Expert Insights

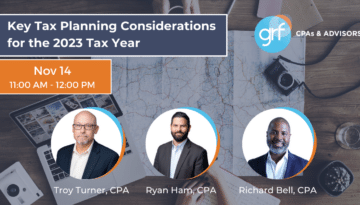

Webinar

Key Tax Planning Considerations for the 2023 Tax Year

It’s time for our most heavily attended webinar annually! As the calendar year draws to a close, now is the…

Articles

2023 Year-End Tax Planning Resources

We’ve compiled some year-end tax planning resources to help you prepare for your 2023 returns. Bookmark this page! More resources…

Articles

Four Midyear 2023 Tax Planning Tips for Small Business Owners

Mid-July isn’t just for barbeques and baseball. It’s also a good time to think about ways to cut your 2023…

Articles

Six Ideas for Lowering Your Personal 2023 Taxes

Although summer is a time for vacations and relaxing in the backyard, you can’t afford to take a break from…

Webinar

Key Tax Planning Considerations for the 2022 Tax Year

2022 has been marked by global uncertainty including supply chain issues, economic volatility, record inflation, and continued concerns about the…

Articles

2022 Year-End Tax Planning Series

The Year-End Tax Planning Series provides a roadmap for taxpayers navigating the many tax planning opportunities available this year. The…

Webinar

Introduction to US Taxation for Inbound/Outbound Expatriates

Join Humentum and Industry Partner GRF CPA & Advisors to understand the key tax rules and concepts of expatriate taxation…

Articles, Industry Alerts

Biden Signs Inflation Reduction Act with New Clean Energy Incentives

GRF tax experts offer some preliminary highlights from the new legislation, including tax breaks and clean energy incentives.

Industry Alerts

IRS Clarifies Tax Treatment of Expenses Paid with PPP Loans

As thousands of businesses and nonprofit organizations prepare and submit their Paycheck Protection Program (PPP) loan forgiveness applications, they may…

Webinar

Webinar Series: The Indirect Rate Toolkit for Nonprofits with Federal Grants – Part III

Building on the first two webinars in the series, this session provides a nonprofit federal award recipient an example and…

Webinar

Virtual Audits in a Time of Crisis

As the industry moves towards a paperless environment, the virtual or remote audit is becoming more popular. Is it right…

Webinar

Strategies for Nonprofit Fundraising During a Global Crisis

Many charitable organizations find themselves in a time of crisis as the global economy slows to accommodate social distancing. The…

Industry Alerts

May Deadline Approaching for Filing BE-10 Forms

The Department of Commerce’s Bureau of Economic Analysis (BEA) requires all U.S. reporters including U.S. individual taxpayers, estates and trusts,…

Webinar

Maximizing PPP Loan Forgiveness

This webinar led by our tax and accounting experts walked participants through the PPP loan requirements for forgiveness. They provided…

Industry Alerts

President Trump Signs Bill with an Additional $320B for the PPP

Join GRF for a webinar led by our tax and accounting experts who will walk participants through the PPP loan…

Webinar

Annual Tax Planning

With the year coming to a close and the income tax deadline around the corner, now is the time to…

Webinar

2018 Year-End Tax Planning

With the year coming to a close and the income tax filing deadline near, now is the time to invest…

Articles

More businesses will have to charge sales tax in more states under recent U.S. Supreme Court ruling

By: Karen T. Syrylo, CPA States no longer need to restrict their sales tax collection requirements to only sellers that…

Webinar

Unraveling the Complexity of Expatriate Taxation: How Employers Can Achieve Compliance and Promote Employee Satisfaction

Join Humentum and Gelman, Rosenberg & Freedman CPAs for an overview of common expatriate tax issues and an overview of…

Webinar

2017 Year End Income Tax Update

Join Gelman, Rosenberg & Freedman CPAs for a webinar focused on life events, economic conditions and tax strategies you should…

Webinar

Unraveling the Complexity of Expatriate Taxation: How Employers Can Achieve Compliance and Promote Employee Satisfaction

Join Gelman, Rosenberg & Freedman CPAs for an overview of common expatriate tax issues and an overview of the complex…

Articles

What Can Employers Do with Forfeited Employee FSA Balances?

When unused flexible spending account (FSA) balances are forfeited back to employers under the “use-it-or-lose-it” rule, employers have several options…

News and Events

Key Tax Planning Considerations for the 2023 Tax Year

Join GRF’s tax experts for our annual tax planning webinar as we explore best practices for reducing your tax liability.…

Key Tax Planning Considerations for the 2022 Tax Year

Join GRF’s tax experts for our annual tax planning webinar as we explore best practices for reducing your tax liability.…

Introduction to US Taxation for Inbound/Outbound Expatriates

Join GRF and Industry Partner Humentum to explore background information and tools for expats and their employers to effectively address…

Annual Tax Planning Webinar: Important Considerations for the 2021 Tax Year

Join GRF’s tax experts to learn best practices for improving your financial position, leveraging new tax rules, and taking advantage…

Treasury Delays April 15 Payment Deadline and Allows Deferral of Some Tax Liability

Our offices are currently closed to protect the health and wellbeing of GRF’s employees, clients and other visitors. Employees will…

Navigating the New Meals and Entertainment Deductions under TCJA

By Marc Neri, EA, CVA | Supervisor, Tax It is common for businesses to dine and entertain clients, vendors, and…

2018 Year-End Tax Planning Roundtable

Join Gelman, Rosenberg & Freedman CPAs and Sandy Spring Bank for an invitation-only presentation and roundtable discussion with recognized tax…

2018 Year-End Tax Planning

Join Gelman, Rosenberg & Freedman CPAs for a webinar focused on the significant changes to individual and small business tax…

Unraveling the Complexity of Expatriate Taxation: How Employers Can Achieve Compliance and Promote Employee Satisfaction

Join Humentum and Gelman, Rosenberg & Freedman CPAs for an overview of common expatriate tax issues and an overview of…

Taxation Management: Expats, TCNs & Organizational Risk

GRF Partner Troy Turner, CPA and Principal Kathleen Curtis Fisken, EA, LPA, ATA will be speaking on a panel at a Humentum…

Gelman, Rosenberg & Freedman Presents Best Practices for Management and Individuals Working Overseas

International non-governmental organizations often face unique financial management and tax concerns for their operations and for employees and contractors who…